Advancements in Treatment Technologies

Technological advancements are playing a pivotal role in shaping the medical aesthetics market. Innovations in treatment methodologies, such as laser technology and minimally invasive techniques, are enhancing the efficacy and safety of procedures. These advancements not only improve patient outcomes but also reduce recovery times, making treatments more appealing to a broader audience. The introduction of new devices and techniques is expected to contribute to market growth, with the potential for the medical aesthetics market to expand by approximately 15% in the coming years. As technology continues to evolve, practitioners are likely to adopt these innovations to remain competitive.

Growing Demand for Aesthetic Procedures

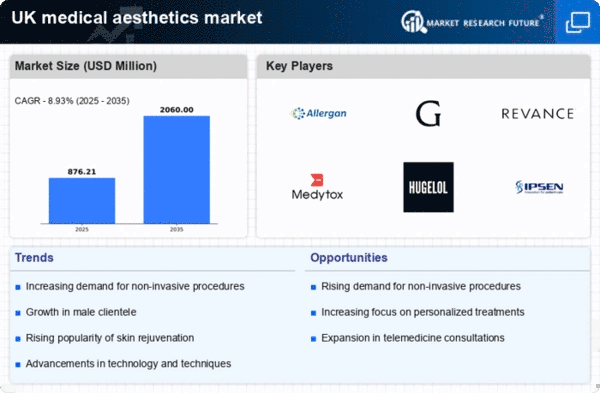

The medical aesthetics market in the UK is experiencing a notable increase in demand for aesthetic procedures. This trend is driven by a rising societal acceptance of cosmetic enhancements, with more individuals seeking treatments to improve their appearance. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. This growth is attributed to factors such as increased disposable income and a greater emphasis on personal grooming. As consumers become more aware of the available options, the medical aesthetics market is likely to expand, with a diverse range of treatments being offered to meet varying preferences.

Regulatory Developments and Industry Standards

The medical aesthetics market is currently navigating a landscape of evolving regulatory frameworks and industry standards. Recent initiatives aimed at enhancing patient safety and treatment efficacy are likely to impact market dynamics. Regulatory bodies are increasingly focusing on ensuring that practitioners adhere to stringent guidelines, which may lead to a more professional and trustworthy environment for consumers. This emphasis on regulation could foster greater consumer confidence in the medical aesthetics market, potentially resulting in increased demand for certified practitioners and approved treatments. As the industry adapts to these changes, it may experience a stabilizing effect on growth.

Influence of Social Media and Celebrity Culture

The impact of social media and celebrity culture on the medical aesthetics market cannot be overstated. Platforms such as Instagram and TikTok have created a culture where aesthetic procedures are frequently showcased, leading to heightened awareness and interest among the public. This phenomenon appears to drive younger demographics to seek treatments that enhance their appearance, often inspired by influencers and celebrities. As a result, the medical aesthetics market is witnessing a surge in demand for procedures that are visually appealing and shareable on social media. This trend suggests that marketing strategies focusing on digital platforms may be crucial for businesses operating within this market.

Increased Awareness of Mental Health and Wellbeing

There is a growing recognition of the connection between physical appearance and mental health, which is influencing the medical aesthetics market. Many individuals are seeking aesthetic treatments not only for cosmetic reasons but also to boost their self-esteem and overall wellbeing. This trend indicates a shift in consumer motivations, where the desire for aesthetic enhancements is intertwined with mental health considerations. As awareness of this relationship increases, the medical aesthetics market may see a rise in demand for procedures that promote confidence and self-image, potentially leading to a market growth rate of around 8% over the next few years.