Rise of Medical Tourism

South Korea has emerged as a prominent destination for medical tourism, particularly in the medical aesthetics market. The country is renowned for its high-quality aesthetic services and competitive pricing, attracting international patients seeking cosmetic enhancements. In 2025, it is estimated that medical tourism will contribute approximately $1 billion to the medical aesthetics market. This influx of foreign patients not only boosts revenue but also encourages local clinics to enhance their service offerings and maintain high standards. The growing reputation of South Korea as a hub for aesthetic procedures is likely to sustain the market's growth trajectory, as more individuals from abroad seek out its advanced medical aesthetics services.

Increasing Demand for Aesthetic Procedures

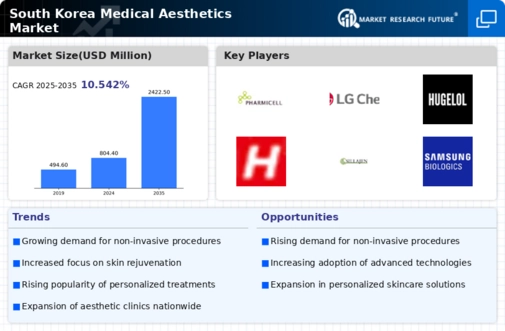

The medical aesthetics market in South Korea is experiencing a notable surge in demand for aesthetic procedures. This trend is driven by a growing societal emphasis on physical appearance and self-image. According to recent data, the market is projected to reach approximately $3 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This increasing demand is particularly evident among younger demographics, who are more inclined to seek out non-invasive treatments. The rise in social media influence also plays a crucial role, as individuals aspire to achieve the idealized beauty standards often showcased online. Consequently, the medical aesthetics market is likely to continue expanding as more individuals prioritize aesthetic enhancements in their personal care routines.

Growing Awareness of Mental Health and Self-Care

There is a rising awareness of the connection between mental health and self-care in South Korea, which is positively impacting the medical aesthetics market. Individuals increasingly recognize that aesthetic procedures can enhance self-esteem and overall well-being. This shift in perception is leading to a greater acceptance of cosmetic enhancements as a form of self-care rather than mere vanity. As mental health becomes a focal point in societal discussions, the medical aesthetics market is likely to benefit from this trend. Projections suggest that the market could reach $4 billion by 2028, as more individuals seek aesthetic treatments to improve their mental and emotional health.

Technological Integration in Aesthetic Treatments

Technological advancements are significantly shaping the medical aesthetics market in South Korea. The integration of cutting-edge technologies, such as laser treatments and advanced imaging systems, enhances the efficacy and safety of aesthetic procedures. For instance, the introduction of AI-driven diagnostic tools allows practitioners to tailor treatments more precisely to individual needs. This technological evolution not only improves patient outcomes but also boosts consumer confidence in undergoing procedures. As a result, the market is expected to grow, with estimates suggesting a valuation of $3.5 billion by 2027. The continuous innovation in technology is likely to attract a broader clientele, further propelling the medical aesthetics market forward.

Influence of Social Media and Celebrity Endorsements

The medical aesthetics market in South Korea is heavily influenced by social media and celebrity endorsements. Platforms such as Instagram and YouTube serve as powerful marketing tools, where influencers and celebrities showcase their aesthetic transformations. This visibility creates a strong desire among the public to pursue similar enhancements, thereby driving market growth. Recent surveys indicate that nearly 60% of individuals aged 18-35 are motivated to seek aesthetic procedures due to social media exposure. As a result, the medical aesthetics market is likely to see continued expansion, as the interplay between social media trends and consumer behavior fosters a culture of aesthetic enhancement.