Advancements in Treatment Technologies

Technological innovations are transforming the medical aesthetics market, enhancing the efficacy and safety of various procedures. New devices and techniques, such as laser technologies and advanced injectables, are being developed, offering improved results with reduced downtime. For instance, the introduction of non-invasive body contouring technologies has gained traction, appealing to consumers seeking effective solutions without surgical intervention. As these advancements continue to emerge, they are expected to attract a broader audience, including those who may have previously been hesitant to undergo aesthetic treatments. The medical aesthetics market is thus positioned for growth, driven by the continuous evolution of treatment technologies.

Growing Demand for Aesthetic Treatments

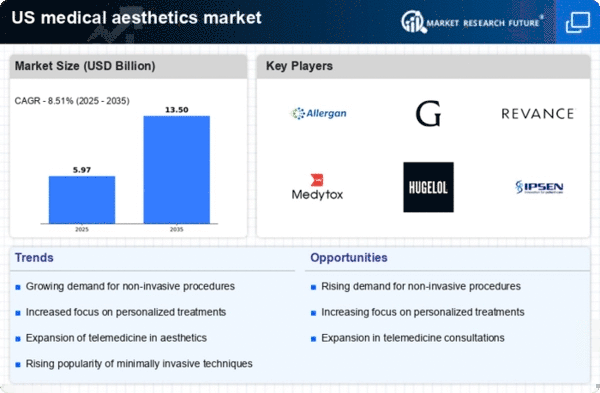

The medical aesthetics market is experiencing a notable increase in demand for aesthetic treatments, driven by a rising societal emphasis on physical appearance. This trend is particularly evident among younger demographics, who are increasingly seeking non-invasive procedures to enhance their looks. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. This growth is fueled by the desire for quick recovery times and minimal discomfort associated with non-surgical options. As more individuals prioritize self-care and personal grooming, the medical aesthetics market is likely to expand, catering to a diverse clientele seeking various treatments, from injectables to skin rejuvenation therapies.

Increased Accessibility of Aesthetic Services

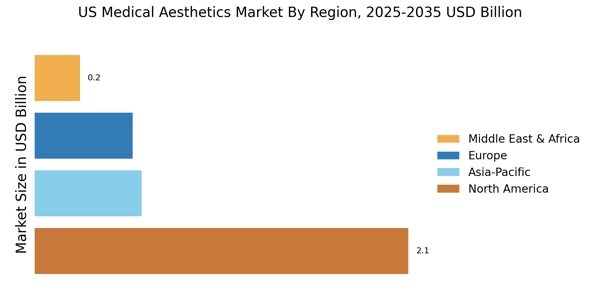

The medical aesthetics market is witnessing increased accessibility to aesthetic services, which is likely to drive market growth. The expansion of clinics and treatment centers across urban and suburban areas has made aesthetic procedures more available to a wider audience. Additionally, competitive pricing strategies and financing options are making treatments more affordable for consumers. This trend is particularly relevant as more individuals seek to invest in their appearance, leading to a rise in the number of procedures performed annually. As accessibility improves, the medical aesthetics market is expected to flourish, catering to a diverse range of clients seeking various aesthetic enhancements.

Influence of Social Media and Celebrity Culture

The medical aesthetics market is significantly influenced by social media platforms and celebrity endorsements, which play a crucial role in shaping public perceptions of beauty. The proliferation of platforms such as Instagram and TikTok has created a culture where aesthetic enhancements are not only normalized but celebrated. Influencers and celebrities often share their experiences with aesthetic procedures, leading to increased interest and inquiries among their followers. This trend appears to be driving a surge in demand for treatments, as individuals aspire to achieve similar looks. Consequently, the medical aesthetics market is likely to see continued growth as social media continues to shape beauty standards and consumer behavior.

Rising Awareness of Mental Health and Self-Image

The medical aesthetics market is increasingly intersecting with the growing awareness of mental health and self-image. As individuals recognize the impact of physical appearance on self-esteem and overall well-being, there is a heightened interest in aesthetic treatments as a means of enhancing self-confidence. This trend is particularly pronounced among younger generations, who are more open to discussing mental health issues and the role of aesthetics in personal satisfaction. The medical aesthetics market is likely to benefit from this shift, as more individuals seek treatments that align with their desire for improved self-image and mental wellness.