Rising Demand for E-commerce

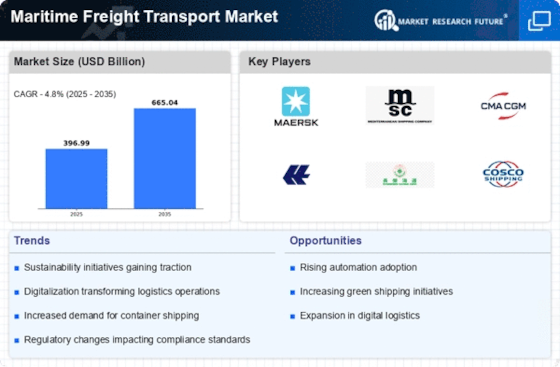

The surge in e-commerce activities has led to an increased demand for the Maritime Freight Transport Market. As consumers increasingly prefer online shopping, the need for efficient logistics and shipping solutions has become paramount. In 2025, it is estimated that e-commerce sales will reach approximately 6 trillion USD, necessitating robust maritime transport capabilities to handle the growing volume of goods. This trend indicates that maritime freight transport will play a crucial role in meeting the logistical challenges posed by e-commerce, thereby driving growth in the industry.

Technological Advancements in Shipping

Technological innovations are transforming the Maritime Freight Transport Market, enhancing operational efficiency and reducing costs. The adoption of automation, artificial intelligence, and blockchain technology is streamlining shipping processes, improving tracking, and ensuring transparency in transactions. For instance, the implementation of smart shipping solutions is projected to reduce operational costs by up to 20% by 2026. These advancements not only optimize supply chain management but also contribute to sustainability efforts, making the maritime sector more competitive and appealing to stakeholders.

Global Trade Dynamics and Economic Growth

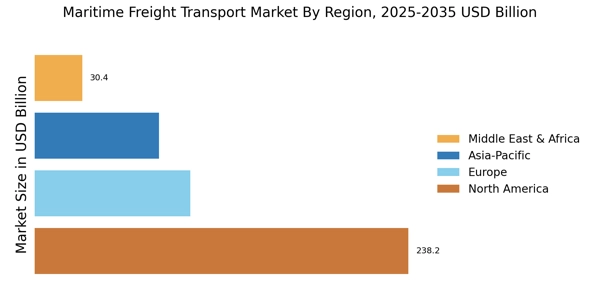

The dynamics of The Maritime Freight Transport Industry. As economies recover and expand, the demand for maritime transport services is likely to increase. In 2025, global trade volumes are projected to rise by approximately 4% annually, driven by emerging markets and increased consumer demand. This growth presents opportunities for maritime freight transport providers to expand their services and enhance their market presence, thereby contributing to the overall development of the industry.

Infrastructure Development and Investment

Investment in port infrastructure and logistics facilities is a critical driver for the Maritime Freight Transport Market. Governments and private entities are increasingly recognizing the importance of modernizing ports to accommodate larger vessels and improve efficiency. In 2025, global investments in port infrastructure are expected to exceed 100 billion USD, aimed at enhancing capacity and reducing turnaround times. This influx of capital is likely to bolster the maritime freight sector, facilitating smoother operations and attracting more shipping lines to utilize these upgraded facilities.

Environmental Regulations and Sustainability Goals

The Maritime Freight Transport Market is experiencing a shift due to stringent environmental regulations aimed at reducing carbon emissions. As countries implement policies to combat climate change, shipping companies are compelled to adopt greener practices. The International Maritime Organization has set ambitious targets to reduce greenhouse gas emissions by at least 50% by 2050. This regulatory landscape is driving innovation in fuel efficiency and alternative energy sources, positioning the maritime sector as a key player in the global sustainability movement.