Strategic Port Developments

Strategic developments in port infrastructure are crucial for the maritime freight-transport market in France. The government is investing heavily in modernizing ports to accommodate larger vessels and improve efficiency. For instance, the Port of Le Havre is undergoing significant upgrades, which are expected to increase its capacity by 20% by 2026. These enhancements not only facilitate smoother operations but also attract more shipping lines, thereby boosting trade volumes. Additionally, improved connectivity between ports and inland transport networks is likely to enhance the overall logistics framework, making the maritime freight-transport market more competitive. As ports evolve, they will play a vital role in shaping the future of shipping in France.

Technological Advancements in Shipping

The maritime freight-transport market in France is experiencing a notable shift due to technological advancements. Innovations such as automated cargo handling systems and advanced navigation technologies are enhancing operational efficiency. For instance, the integration of AI and IoT in shipping logistics is streamlining processes, reducing turnaround times, and minimizing human error. This technological evolution is projected to increase productivity by approximately 15% over the next few years. Furthermore, the adoption of blockchain technology is improving transparency and security in transactions, which is crucial for maintaining trust in the maritime freight-transport market. As these technologies continue to evolve, they are likely to reshape the competitive landscape, compelling companies to invest in modern solutions to stay relevant.

Environmental Sustainability Initiatives

Environmental sustainability initiatives are increasingly influencing the maritime freight-transport market in France. With growing awareness of climate change, shipping companies are under pressure to adopt greener practices. The French government has set ambitious targets to reduce greenhouse gas emissions from the maritime sector by 30% by 2030. This regulatory push is prompting companies to invest in cleaner technologies, such as LNG-powered vessels and energy-efficient shipping practices. As a result, the maritime freight-transport market is likely to witness a shift towards more sustainable operations, which could enhance the industry's reputation and attract environmentally conscious clients. The transition to sustainability may also open new avenues for innovation and collaboration within the sector.

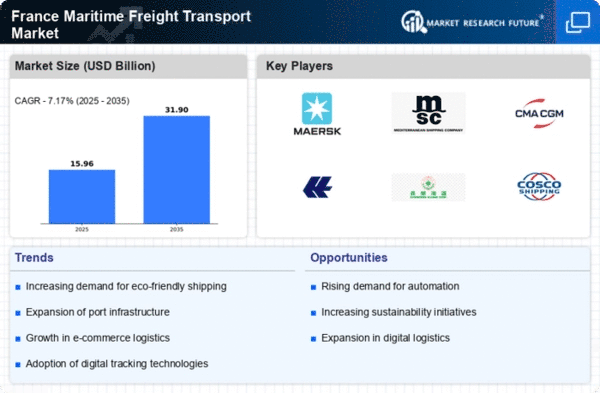

Growth of E-commerce and Consumer Demand

The rise of e-commerce is significantly impacting the maritime freight-transport market in France. As online shopping continues to gain traction, the demand for efficient shipping solutions is escalating. In 2025, e-commerce sales in France are projected to reach €150 billion, necessitating robust logistics and transportation networks. This surge in consumer demand is prompting shipping companies to optimize their operations, leading to increased investments in fleet expansion and modernization. Consequently, the maritime freight-transport market is likely to experience heightened competition as companies strive to meet the evolving needs of consumers. This trend may also drive innovation in service offerings, such as faster delivery options and enhanced tracking capabilities.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a pivotal role in shaping the maritime freight-transport market in France. The implementation of stringent safety standards and environmental regulations is driving companies to enhance their operational protocols. Compliance with the International Maritime Organization (IMO) regulations, particularly concerning emissions, is becoming increasingly critical. Companies that fail to adhere to these regulations may face substantial fines, which could reach up to €1 million. This regulatory landscape compels businesses to invest in cleaner technologies and practices, thereby influencing their operational costs and strategies. As a result, the maritime freight-transport market is likely to see a shift towards more sustainable practices, enhancing the overall safety and reliability of shipping operations.