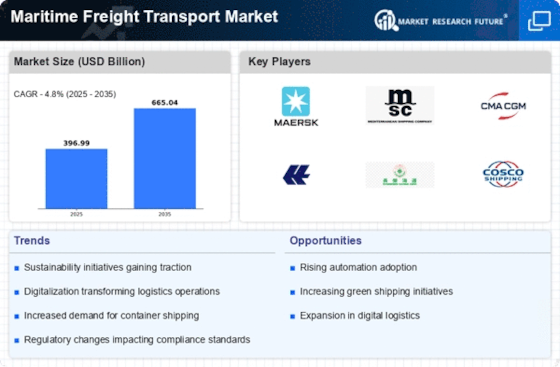

Top Industry Leaders in the Maritime Freight Transport Market

The maritime freight transport market, the lifeblood of global trade, is a dynamic and complex landscape. With over 90% of the world's goods traversing the oceans, understanding the competitive forces shaping this industry is crucial for businesses, policymakers, and anyone invested in the flow of global commerce.

Dominant Strategies:

-

Scale and Network Advantage: Global giants like Maersk, MSC, and CMA-CGM wield immense fleet size and extensive port networks, offering economies of scale and schedule reliability. Maersk, for instance, recently acquired Hamburg Süd, further solidifying its dominance.

-

Alliance Power: Alliances like Ocean Alliance and 2M+ act as virtual mergers, sharing vessels and optimizing capacity utilization. This collaborative approach minimizes operational costs and offers shippers wider port coverage.

-

Diversification and Digitization: Leading players are diversifying beyond containerized cargo, investing in bulk carriers and specialized vessels. Simultaneously, digitization efforts are underway, with platforms like Maersk's TradeLens improving supply chain visibility and efficiency.

-

Sustainable Shipping: Eco-conscious initiatives are gaining traction, with green technology adoption and alternative fuels like LNG and ammonia being explored. MSC announced plans for 10 LNG-powered mega-vessels in August 2023, showcasing the industry's growing commitment to sustainability.

Factors Influencing Market Share:

-

Trade Dynamics: Global trade fluctuations directly impact shipping demand. The ongoing US-China trade war and geopolitical tensions continue to disrupt trade patterns, presenting both challenges and opportunities for specific routes and players.

-

Port Efficiency and Infrastructure: Congestion at key ports like Los Angeles and Long Beach can significantly impact shipping costs and schedules. Investments in port infrastructure and automation are crucial for smooth cargo flow.

-

Fuel Costs and Bunker Prices: Fluctuations in oil prices directly impact operational costs for shipping lines. The OPEC+ production cut in October 2023 led to a surge in bunker prices, putting pressure on smaller players with tighter margins.

-

Technological Advancements: Automation, blockchain, and AI are revolutionizing the industry. Companies like ONE are implementing AI-powered route optimization to reduce fuel consumption and optimize schedules.

Key Companies in the Maritime Freight Transport market include

- AP Moller (Maersk)

- China Ocean Shipping (Group) Company (COSCO)

- Mediterranean Shipping Company S.A. (MSC)

- CMA-CGM

- Hapag-Lloyd

- Ocean Network Express

- Evergreen Line

- HMM Co. Ltd.

- Yang Ming Marine Transport,

- Zim

Recent Development

November 2023: Maersk, a Danish shipping giant, partnered with IBM to develop and implement a new digital platform for managing maritime logistics. This partnership aims to improve efficiency and transparency in the supply chain.

September 2023: Hapag-Lloyd and CMA CGM signed a memorandum of understanding to cooperate on operational matters, such as vessel sharing and port optimization. This partnership aims to improve operational efficiency and reduce costs.

July 2023: Japanese shipping company ONE and Israeli shipping company ZIM agreed to cooperate on container sharing and slot exchange agreements. This partnership aims to improve network coverage and offer more competitive services to customers.