Low Cost Carrier Market Summary

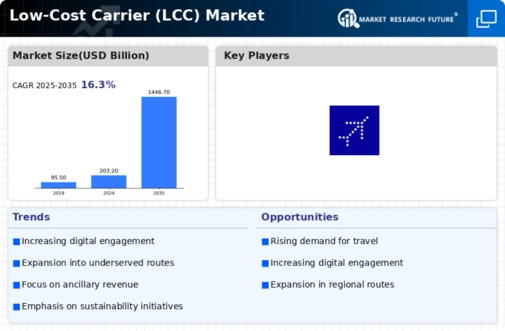

As per Market Research Future analysis, the Low-Cost Carrier (LCC) Market Size was estimated at 203.16 USD Billion in 2024. The Low-Cost Carrier industry is projected to grow from 236.27 USD Billion in 2025 to 1069.56 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 16.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Low-Cost Carrier market is experiencing robust growth driven by technological advancements and increasing demand for affordable travel.

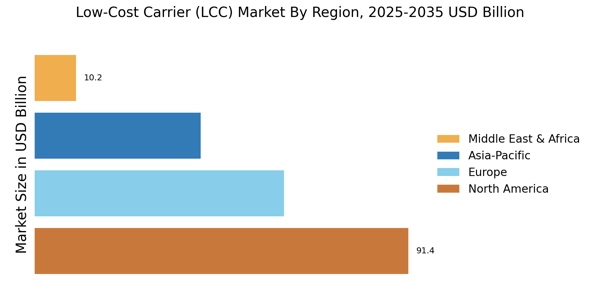

- The expansion of route networks is a prominent trend among low-cost carriers, particularly in North America, which remains the largest market.

- Technological integration is enhancing operational efficiency, allowing carriers to optimize costs and improve customer experience.

- Sustainability initiatives are gaining traction, especially in the Asia-Pacific region, which is recognized as the fastest-growing market for low-cost carriers.

- The increasing demand for affordable travel and the expansion of ancillary revenue streams are key drivers propelling the growth of narrow-body aircraft in the online segment.

Market Size & Forecast

| 2024 Market Size | 203.16 (USD Billion) |

| 2035 Market Size | 1069.56 (USD Billion) |

| CAGR (2025 - 2035) | 16.3% |

Major Players

Ryanair (IE), easyJet (GB), Southwest Airlines (US), AirAsia (MY), JetBlue Airways (US), Wizz Air (HU), Spirit Airlines (US), IndiGo (IN), VivaAerobus (MX)