Growing Commercial Applications

The low cost-satellite market is experiencing a surge in commercial applications, driven by the increasing need for data in various sectors such as agriculture, telecommunications, and environmental monitoring. Businesses are recognizing the value of satellite data for precision farming, supply chain management, and disaster response. The market is projected to reach approximately $7 billion by 2026, indicating a robust growth trajectory. This expansion is likely fueled by the affordability of satellite technology, enabling small and medium enterprises to leverage satellite data for competitive advantage. As more companies enter the market, the demand for low cost-satellite services is expected to rise, further propelling the industry forward.

Emergence of New Market Entrants

The low cost-satellite market is witnessing the emergence of new entrants, which is reshaping the competitive landscape. Startups and established companies alike are recognizing the potential of low cost-satellite technology and are entering the market with innovative solutions. This influx of new players is likely to drive competition, leading to lower prices and improved services for consumers. Additionally, the entry of new companies is fostering collaboration and partnerships, which can enhance technological advancements and operational efficiencies. As the market continues to evolve, the presence of diverse players is expected to contribute to the overall growth and dynamism of the low cost-satellite market.

Increased Government Support and Funding

Government initiatives and funding are increasingly supporting the low cost-satellite market. Various federal agencies, including NASA and the National Oceanic and Atmospheric Administration (NOAA), are investing in satellite technology to enhance national security, environmental monitoring, and scientific research. In recent years, funding for small satellite missions has increased, with budgets allocated for innovative projects that utilize low cost-satellite technology. This support not only fosters innovation but also encourages collaboration between government and private sectors, creating a more dynamic ecosystem for the low cost-satellite market. As government interest continues to grow, it is likely to stimulate further investment and development in this sector.

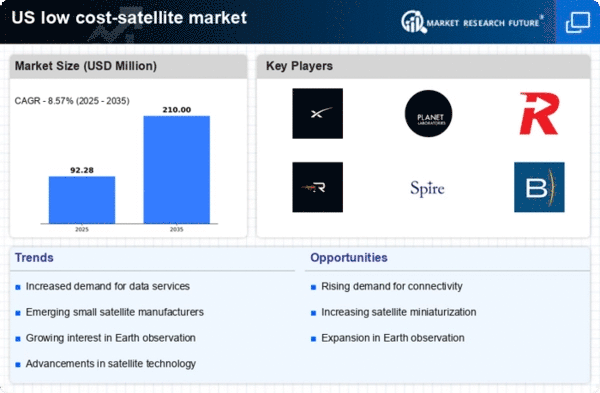

Rising Demand for Connectivity Solutions

The demand for connectivity solutions is a significant driver of the low cost-satellite market. As the need for reliable internet access expands, particularly in remote and underserved areas, low cost-satellites are emerging as a viable solution. Companies are deploying satellite constellations to provide broadband services, which is particularly appealing in regions where traditional infrastructure is lacking. The market for satellite-based internet services is expected to grow substantially, with estimates suggesting a potential increase of over 30% in the next five years. This trend indicates a strong market opportunity for low cost-satellite providers to meet the growing connectivity needs of consumers and businesses alike.

Technological Innovations in Satellite Design

Innovations in satellite design are playing a crucial role in the low cost-satellite market. Advances in miniaturization and materials science have led to the development of smaller, lighter satellites that can be produced at a fraction of the cost of traditional satellites. For instance, the use of commercial off-the-shelf components has reduced manufacturing costs significantly. This trend is likely to continue, as companies invest in research and development to enhance satellite capabilities while keeping costs low. The introduction of new technologies, such as 3D printing, is also expected to streamline production processes, making it easier for new entrants to participate in the low cost-satellite market.