Expansion of LPG Infrastructure

The expansion of LPG infrastructure plays a crucial role in driving the Liquefied Petroleum Gas Market. Investments in storage facilities, distribution networks, and refueling stations are essential for meeting the increasing demand for LPG. Countries are actively enhancing their infrastructure to facilitate the seamless supply of LPG to both residential and commercial sectors. For instance, the construction of new terminals and pipelines has been reported to increase the availability of LPG in previously underserved areas. This infrastructure development not only supports the growth of the LPG market but also enhances energy security by diversifying supply sources. As a result, the accessibility of LPG is expected to improve, potentially leading to a rise in consumption rates across various sectors.

Rising Industrial Demand for LPG

The rising industrial demand for Liquefied Petroleum Gas (LPG) is a significant driver for the Liquefied Petroleum Gas Industry. Industries such as petrochemicals, manufacturing, and food processing are increasingly utilizing LPG as a fuel source due to its efficiency and lower emissions. The petrochemical sector, in particular, has shown a growing preference for LPG as a feedstock for producing various chemicals. Reports indicate that the industrial sector accounts for a substantial portion of LPG consumption, with projections suggesting continued growth in this area. As industries strive to enhance operational efficiency and reduce their carbon footprint, the demand for LPG is likely to increase, further solidifying its position in the energy landscape.

Emerging Markets and Economic Growth

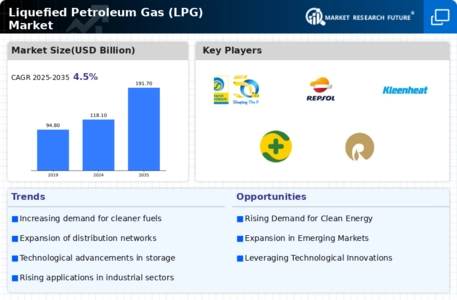

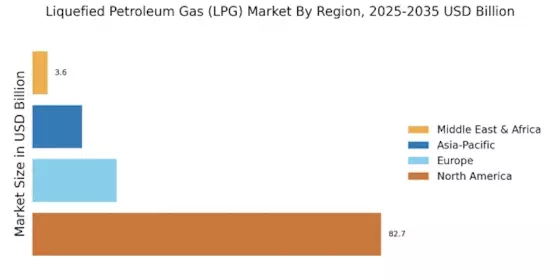

Emerging markets and economic growth are pivotal factors driving the Liquefied Petroleum Gas Market. As economies develop, there is a corresponding increase in energy demand, particularly in developing regions. The expansion of urbanization and rising disposable incomes contribute to the growing consumption of LPG for cooking, heating, and industrial applications. Countries in Asia and Africa are witnessing rapid economic growth, leading to a surge in LPG adoption. Additionally, the establishment of new LPG distribution networks in these regions is expected to facilitate access to this energy source. This trend suggests that as emerging markets continue to grow, the demand for LPG will likely experience a corresponding increase, thereby enhancing its market presence.

Regulatory Support for Cleaner Fuels

Regulatory support for cleaner fuels significantly influences the Liquefied Petroleum Gas Industry. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting cleaner energy alternatives. LPG, being a cleaner-burning fuel compared to coal and oil, benefits from these regulatory frameworks. For example, several countries have set ambitious targets for reducing greenhouse gas emissions, which has led to increased investments in LPG infrastructure and technology. The implementation of stricter emissions standards for vehicles and industrial processes further propels the demand for LPG as a viable alternative. This regulatory environment not only encourages the adoption of LPG but also positions it as a key player in the transition towards sustainable energy solutions.

Increasing Adoption of LPG in Residential Applications

The rising adoption of Liquefied Petroleum Gas (LPG) in residential applications is a notable driver for the Liquefied Petroleum Gas Market. As households seek cleaner and more efficient energy sources, LPG emerges as a preferred choice for cooking and heating. In many regions, the transition from traditional fuels to LPG is encouraged by government incentives and awareness campaigns. This shift is reflected in the increasing number of LPG connections, which has reportedly reached over 300 million globally. Furthermore, the convenience and portability of LPG cylinders enhance its appeal, particularly in urban areas where space is limited. The growing trend towards energy-efficient appliances also supports the demand for LPG, as consumers prioritize sustainability and cost-effectiveness in their energy choices.