Competitive Pricing Dynamics

Competitive pricing within the liquefied petroleum-gas-lpg market is a significant driver influencing consumer choices. As suppliers strive to capture market share, price competition has intensified, leading to more attractive pricing for end-users. In 2025, the average price of LPG is projected to be around $2.50 per gallon, which is competitive compared to other energy sources. This pricing strategy is likely to encourage greater consumption, particularly in sectors such as heating and cooking, thereby bolstering the liquefied petroleum-gas-lpg market as consumers seek cost-effective energy solutions.

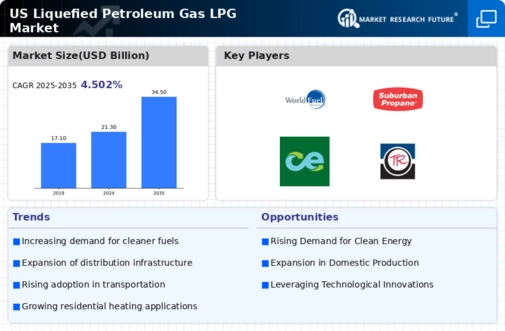

Expansion of LPG Infrastructure

The expansion of liquefied petroleum-gas-lpg infrastructure across the US is a critical driver for the market. Investments in storage facilities, distribution networks, and refueling stations are on the rise, facilitating easier access to LPG for consumers and businesses alike. In 2025, the US is projected to see a 15% increase in LPG distribution points, enhancing the market's reach. This infrastructure development not only supports the growing demand for LPG in various sectors, including transportation and agriculture, but also strengthens the overall liquefied petroleum-gas-lpg market by ensuring a reliable supply chain.

Growing Industrial Applications

The liquefied petroleum-gas-lpg market is benefiting from an increase in industrial applications, particularly in manufacturing and chemical processes. Industries are increasingly recognizing the advantages of LPG as a clean-burning fuel that enhances operational efficiency. In 2025, the industrial sector's consumption of LPG is expected to rise by 12%, driven by the need for reliable energy sources that comply with environmental regulations. This trend not only supports the growth of the liquefied petroleum-gas-lpg market but also positions LPG as a key player in the transition towards more sustainable industrial practices.

Increased Adoption in Transportation

The liquefied petroleum-gas-lpg market is witnessing a surge in adoption within the transportation sector. As companies and municipalities seek to reduce emissions and fuel costs, LPG is emerging as a viable alternative to traditional fuels. In 2025, it is estimated that the use of LPG in transportation will grow by 20%, driven by the implementation of cleaner fuel mandates and incentives for fleet conversions. This shift not only supports environmental goals but also enhances the liquefied petroleum-gas-lpg market by diversifying its applications and expanding its customer base.

Rising Demand for Residential Heating

The liquefied petroleum-gas-lpg market is experiencing a notable increase in demand for residential heating solutions. As colder months approach, households are increasingly turning to LPG for its efficiency and cost-effectiveness. In 2025, approximately 5 million households in the US utilize LPG for heating, representing a 10% increase from previous years. This trend is driven by the need for reliable heating sources, particularly in rural areas where natural gas infrastructure may be lacking. The liquefied petroleum-gas-lpg market is thus positioned to benefit from this growing demand, as consumers seek alternatives that provide both comfort and affordability during winter months.

Leave a Comment