Top Industry Leaders in the Liquefied Petroleum Gas LPG Market

*Disclaimer: List of key companies in no particular order

Competitive Landscape of the Liquefied Petroleum Gas (LPG) Market

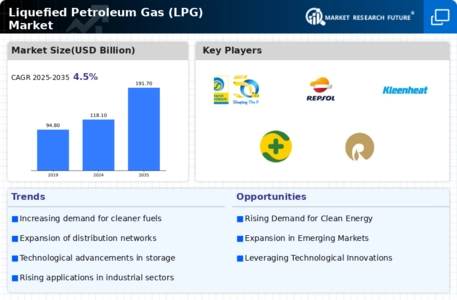

The competitive landscape of the global Liquefied Petroleum Gas (LPG) market is marked by dynamism and competitiveness, featuring a blend of established industry leaders and emerging regional players. Anticipated to undergo consistent growth in the foreseeable future, the market is propelled by factors such as the increasing demand for cleaner cooking fuel alternatives, escalating urbanization, and the rise in disposable incomes.

Key Players and Their Strategies:

- Saudi Arabian Oil Co.

- China Gas Holdings Ltd.

- Chevron Corporation

- Bharat Petroleum Corporation Limited

- Flaga Gmbh

- Repsol

- Kleenheat

- Total Se

- Reliance Industries Limited

- Exxon Mobil Corporation

-

National Oil Companies (NOCs): Dominant contributors to the global LPG market include National Oil Companies (NOCs) such as Saudi Aramco, Sinopec, ADNOC, CNPC, and Petrobras. These entities leverage their access to extensive reserves and robust infrastructure networks. Their strategic focus encompasses expanding production capacity, optimizing logistics and distribution networks, and fortifying their global trading presence.

-

International Oil and Gas Companies (IOCs): IOCs like Exxon Mobil, Shell, BP, Total, and Chevron wield significant market share, utilizing their global reach and brand recognition to broaden their LPG businesses. Actively investing in exploration and production activities, particularly in shale gas regions, these companies aim to secure long-term supply sources.

-

Regional Players: Regional entities such as SHV Energy, Kosan Crisplant, and Vilma Oil are gaining prominence by concentrating on niche segments and delivering customized solutions to meet local demands. These players are also actively investing in infrastructure development and establishing strategic partnerships with local distributors and retailers.

Factors for Market Share Analysis:

Several factors influence market share analysis in the LPG industry:

-

Production Capacity and Supply Chain Efficiency: Companies boasting higher production capacity and efficient supply chains gain a substantial competitive advantage. This allows them to provide competitive prices and maintain stable product availability.

-

Distribution Network and Market Access: The expansiveness of distribution networks and robust relationships with distributors and retailers are pivotal for reaching a broader customer base and ensuring efficient product delivery.

-

Brand Recognition and Reputation: Companies with well-established brand recognition and a reputation for quality and reliability enjoy a competitive edge in capturing market share.

-

Investment in Innovation and New Technologies: Companies investing in research and development to enhance production processes, create cleaner burning LPG products, and explore alternative LPG sources position themselves competitively for the future.

New and Emerging Trends:

The LPG market is witnessing new and emerging trends:

-

Shift towards Cleaner Cooking Fuels: Growing concerns about air pollution and health are driving consumers, particularly in developing countries, towards cleaner cooking fuels like LPG, boosting demand in the residential sector.

-

Increased Use of LPG in Transportation: LPG is emerging as a viable alternative fuel for vehicles, especially in commercial and public transport, owing to its lower emissions and cost-effectiveness.

-

Adoption of Digital Technologies: Companies are increasingly embracing digital technologies such as AI, blockchain, and analytics to enhance operational efficiency, optimize supply chains, and improve the overall customer experience.

-

Focus on Sustainability: Industry players are focusing on reducing their environmental footprint by implementing green technologies and exploring carbon capture and storage solutions.

-

Rise of the Circular Economy: The concept of the circular economy is gaining traction in the LPG industry, with companies exploring ways to reuse and recycle used LPG cylinders and minimize waste generation.

Success in this industry hinges on optimizing production and distribution processes, developing innovative products and services, and fostering strong customer relationships. Additionally, a focus on sustainability and corporate social responsibility initiatives is crucial to gain a competitive edge and attract environmentally conscious consumers.

Industry Developments and Latest Updates:

-

Saudi Arabian Oil Co. (Saudi Aramco): LPG prices in Saudi Arabia have surged, in contrast to Europe where prices are declining. This is attributed partly to price hikes by Sonatrach and Aramco in September, impacting global LPG prices (November 2023: ChemAnalyst).

-

China Gas Holdings Ltd.: No major LPG-specific news was reported for November. However, the company continues to concentrate on expanding its natural gas distribution network, indirectly influencing its LPG business (November 2023: Company website, news archives).

-

Chevron Corporation: Chevron has announced a partnership with a Singaporean company to develop an LPG import terminal in Indonesia. This expansion aims to meet the growing demand for LPG in Southeast Asia (Source: Chevron press release, October 26, 2023).

-

Bharat Petroleum Corporation Limited (BPCL): BPCL has signed a Memorandum of Understanding (MoU) with a Malaysian company to explore collaboration in the LPG sector, including potential joint ventures and technology sharing (Source: BPCL press release, October 18, 2023).