Rising Energy Demand

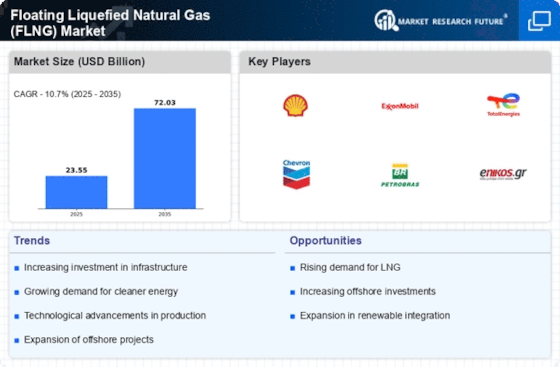

The increasing The Floating Liquefied Natural Gas (FLNG) Industry. As economies expand and populations grow, the need for cleaner energy sources becomes more pressing. Natural gas, being a relatively cleaner fossil fuel, is gaining traction as a preferred energy source. According to recent estimates, the demand for natural gas is projected to rise by approximately 1.5% annually over the next decade. This trend is likely to bolster the FLNG market, as floating facilities can be deployed in remote locations, providing access to untapped reserves. The flexibility and efficiency of FLNG technology enable rapid response to changing energy needs, making it a vital component in meeting future energy requirements.

Technological Innovations

Technological innovations play a crucial role in shaping the Floating Liquefied Natural Gas (FLNG) Market. Advances in liquefaction processes, storage solutions, and floating platform designs have significantly enhanced the efficiency and safety of FLNG operations. For instance, the development of more efficient heat exchangers and compressors has improved the overall energy efficiency of liquefaction processes. Furthermore, innovations in digital technologies, such as real-time monitoring and predictive maintenance, are enhancing operational reliability. These advancements not only reduce operational costs but also minimize environmental impacts, aligning with the industry's shift towards sustainability. As technology continues to evolve, it is expected to further propel the growth of the FLNG market.

Cost-Effectiveness of FLNG Solutions

The cost-effectiveness of Floating Liquefied Natural Gas (FLNG) Market solutions is becoming increasingly apparent. Traditional onshore liquefaction facilities often require substantial capital investment and lengthy construction timelines. In contrast, FLNG facilities can be constructed and deployed more rapidly, reducing time-to-market for natural gas. Recent analyses suggest that FLNG projects can achieve cost savings of up to 30% compared to conventional methods. This financial advantage is particularly appealing to operators looking to optimize their investments in an era of fluctuating energy prices. As the industry continues to seek innovative ways to enhance profitability, the cost benefits associated with FLNG technology are likely to drive further adoption.

Environmental Sustainability Initiatives

Environmental sustainability initiatives are becoming a pivotal driver for the Floating Liquefied Natural Gas (FLNG) Market. As the world grapples with climate change, there is a growing emphasis on reducing greenhouse gas emissions. Natural gas, as a transitional fuel, is viewed as a viable alternative to more carbon-intensive energy sources. The FLNG market is well-positioned to capitalize on this trend, as it allows for the extraction and liquefaction of natural gas in a manner that minimizes environmental disruption. Moreover, the ability to deploy FLNG facilities in remote areas reduces the need for extensive onshore infrastructure, further mitigating environmental impacts. As sustainability becomes a central theme in energy discussions, the FLNG market is likely to benefit from increased investment and interest.

Regulatory Support and Policy Frameworks

Regulatory support and favorable policy frameworks are increasingly influencing the Floating Liquefied Natural Gas (FLNG) Market. Governments worldwide are recognizing the importance of natural gas in achieving energy transition goals and reducing carbon emissions. Policies that promote the development of natural gas infrastructure, including FLNG projects, are being implemented. For example, incentives for investment in cleaner energy technologies and streamlined permitting processes are encouraging the establishment of FLNG facilities. This supportive regulatory environment is likely to enhance investor confidence and stimulate growth in the FLNG sector, as stakeholders seek to align with national energy strategies and sustainability objectives.