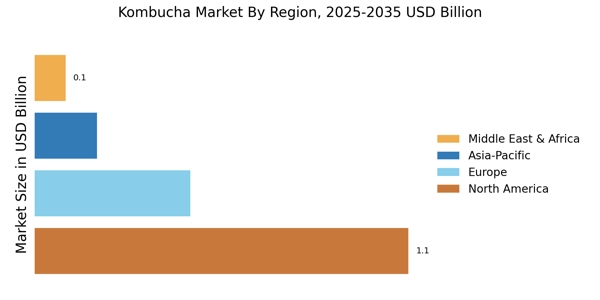

North America : Market Leader in Kombucha Market

North America is the largest market for kombucha, accounting for approximately 60% of the global share. The growth is driven by increasing health consciousness, demand for functional beverages, and a rise in the number of health-focused consumers. Regulatory support for organic and natural products further fuels this trend, with many states promoting local production and sales of kombucha. The market is also witnessing a surge in innovative flavors and packaging options, catering to diverse consumer preferences. The United States is the leading country in this region, with key players like GT's Living Foods, Health-Ade Kombucha Market, and Brew Dr. Kombucha Market dominating the landscape. The competitive environment is characterized by a mix of established brands and emerging startups, all vying for market share. The presence of a robust distribution network, including health food stores and online platforms, enhances accessibility for consumers, further driving market growth.

Europe : Emerging Market for Kombucha Market

Europe is rapidly emerging as a significant market for kombucha, holding approximately 25% of the global market share. The growth is propelled by increasing consumer awareness of health benefits associated with fermented beverages, alongside a shift towards organic and natural products. Regulatory frameworks in several countries are becoming more supportive, encouraging local production and distribution of kombucha, which is expected to further boost market growth in the coming years. Leading countries in this region include Germany, the UK, and France, where the kombucha market is gaining traction. The competitive landscape features both local and international brands, with companies like Kombucha Market Wonder Drink and Humm Kombucha Market making notable inroads. The presence of health food stores, cafes, and online retailers is enhancing product availability, catering to the growing demand for healthier beverage options among European consumers.

Asia-Pacific : Rapid Growth in Kombucha Market

The Asia-Pacific region is witnessing rapid growth in the kombucha market, currently holding about 10% of the global share. This growth is driven by rising health consciousness, increasing disposable incomes, and a growing trend towards wellness beverages. Countries like Australia and Japan are leading the charge, with regulatory bodies beginning to recognize and support the production of kombucha, which is expected to further enhance market dynamics in the region. Australia is the largest market in this region, with a burgeoning number of local brands entering the space. The competitive landscape is characterized by a mix of established players and new entrants, all focusing on innovative flavors and health benefits. The presence of health-conscious consumers and a growing number of retail outlets specializing in organic products are key factors contributing to the market's expansion in Asia-Pacific.

Middle East and Africa : Emerging Kombucha Market

The Middle East and Africa region is an emerging market for kombucha, currently holding around 5% of the global market share. The growth is primarily driven by increasing health awareness and a shift towards natural and organic beverages. Regulatory frameworks are gradually evolving to support the production and sale of kombucha, which is expected to enhance market growth. The region's diverse consumer base is also showing a growing interest in functional beverages, further propelling demand for kombucha. South Africa and the UAE are leading the market in this region, with a growing number of local brands entering the kombucha space. The competitive landscape is still developing, with both local and international players vying for market share. The increasing availability of kombucha in health food stores and online platforms is making it more accessible to consumers, contributing to the overall growth of the market in the Middle East and Africa.