Increased Focus on Energy Efficiency

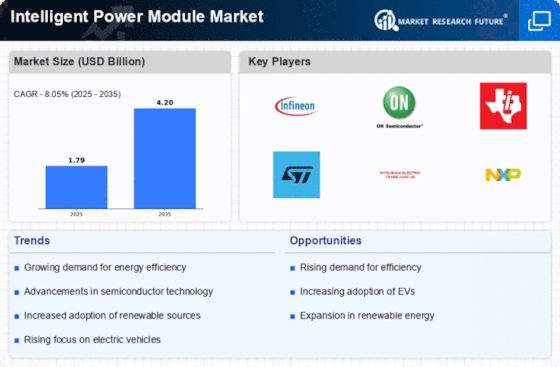

The Intelligent Power Module Market is witnessing a heightened focus on energy efficiency across various sectors. As industries strive to reduce operational costs and meet regulatory standards, the demand for energy-efficient solutions is escalating. Intelligent power modules are integral to achieving these goals, as they facilitate better power management and minimize energy losses in electrical systems. Recent studies suggest that implementing advanced power electronics can lead to energy savings of up to 30% in industrial applications. This trend is particularly relevant in sectors such as manufacturing and renewable energy, where efficiency is paramount. As organizations increasingly recognize the economic and environmental benefits of energy efficiency, the Intelligent Power Module Market is likely to expand, driven by the need for innovative power solutions that align with sustainability objectives.

Growing Adoption of Electric Vehicles

The Intelligent Power Module Market is significantly influenced by the growing adoption of electric vehicles (EVs). As governments and consumers increasingly prioritize sustainability, the demand for efficient power management solutions in EVs is surging. Intelligent power modules play a critical role in managing power distribution and enhancing the performance of electric drivetrains. Recent data indicates that the EV market is expected to reach a valuation of over 800 billion by 2027, with a substantial portion of this growth attributed to advancements in power electronics. This trend is likely to drive the demand for intelligent power modules, as manufacturers seek to optimize energy consumption and improve vehicle range. Consequently, the Intelligent Power Module Market is poised for robust growth, driven by the electrification of transportation and the need for efficient power solutions.

Integration of Smart Grid Technologies

The Intelligent Power Module Market is being propelled by the integration of smart grid technologies. As energy systems evolve towards greater automation and connectivity, intelligent power modules are becoming essential components in smart grid applications. These modules enable real-time monitoring and control of power distribution, enhancing grid reliability and efficiency. The Intelligent Power Module is projected to grow significantly, with investments in smart infrastructure expected to exceed 100 billion by 2026. This growth is likely to create substantial opportunities for the Intelligent Power Module Market, as utilities and energy providers seek to implement advanced power management solutions. The integration of intelligent power modules into smart grids not only improves operational efficiency but also supports the transition towards renewable energy sources, further driving market demand.

Advancements in Semiconductor Technology

The Intelligent Power Module Market is experiencing a notable transformation due to advancements in semiconductor technology. Innovations in materials such as silicon carbide (SiC) and gallium nitride (GaN) are enhancing the efficiency and performance of power modules. These materials allow for higher voltage and temperature operations, which are crucial for applications in electric vehicles and renewable energy systems. The market for SiC and GaN devices is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. This technological evolution not only improves energy efficiency but also reduces the overall size and weight of power modules, making them more suitable for compact applications. As a result, the Intelligent Power Module Market is likely to witness increased adoption across various sectors, including automotive and industrial applications.

Rising Demand for Renewable Energy Solutions

The Intelligent Power Module Market is increasingly influenced by the rising demand for renewable energy solutions. As the world shifts towards sustainable energy sources, the need for efficient power conversion and management becomes critical. Intelligent power modules are pivotal in optimizing the performance of renewable energy systems, such as solar inverters and wind turbines. Recent forecasts indicate that the renewable energy market is expected to surpass 2 trillion by 2030, with a significant portion of this growth attributed to advancements in power electronics. This trend is likely to drive the adoption of intelligent power modules, as they enhance the efficiency and reliability of renewable energy systems. Consequently, the Intelligent Power Module Market is poised for growth, fueled by the global transition towards cleaner energy solutions.