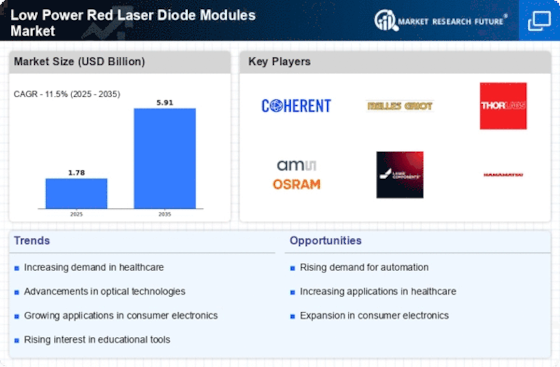

Leading market players are putting a lot of money on R&D to broaden the range of their goods, which will help the market for Low Power Red Laser Diode Modules Market grow even more. Additionally, market participants are engaging in a range of strategic initiatives to increase their worldwide reach, with important market developments such as the introduction of new products, contracts, mergers and acquisitions, increased investments, and cooperation with other businesses. To grow and endure in an increasingly competitive and challenging market environment, Low Power Red Laser Diode Modules industry must provide reasonably priced goods.

One of the main business strategies employed by manufacturers is to produce locally to reduce operational expenses in the global Low Power Red Laser Diode Modules industry to develop market sector and provide benefits to customers. In recent years, the Low Power Red Laser Diode Modules industry has provided some of the most important benefits for medical sector.

Major players in the Low Power Red Laser Diode Modules Market, including Coherent, Hamamatsu Photonics, Monocrom, Photonics Laboratories, EKSPLA, Quantel, Beamtech China, NeoLASE, CrystaLaser, ESi, SOC Showa Optronics, and others, invest in operations for research and development in an effort to improve market demand.

Hamamatsu Photonics K.K. produces optical sensors, electrically powered light sources, various optical devices, and the equipment that employ them for scientific, technical, and medical applications. Former student of "the father of Japanese television" Kenjiro Takayanagi, Heihachiro Horiuchi launched the business in 1953. Hamamatsu is cited as an example of a "Hidden Champion" by prominent German business author and thinker Hermann Simon in his book Hidden Champions of the Twenty-First Century: The Successful Strategies of Unknown World Market Leaders.

In July By building manufacturing Building No. 5 at the Joko factory location in Japan, Hamamatsu Photonics increased its geographic reach.

The facility would manage the rising demand for imaging and measurement devices such semiconductor failure analysis systems, digital cameras created for scientific measurement, and digital slide scanners.

Coherent, Inc., develops, produces, and offers support for laser equipment and related specialty components from its headquarters in Santa Clara, California. With five other individuals, physicist James Hobart started Coherent in May 1966. In 1970, it became public. Coherent developed its line of lasers over time to include those used in a variety of fields and applications. Its revenues increased from $400 million to roughly $2 billion between 2004 and 2021, thanks in part to a number of acquisitions. After acquiring Coherent, Inc. in 2022, II-VI Incorporated changed its name to Coherent Corp.

In July 2022, By combining their businesses through this transaction, II?VI and Coherent became a leader in materials, networking, and lasers. The acquisition combined Coherent's scale, where laser systems are used, with II-VI's scale at value chain levels where material expertise is required.