Regulatory Compliance

The Global Industrial Safety Market Industry is significantly influenced by stringent regulatory frameworks established by governmental bodies. These regulations mandate organizations to implement safety protocols and equipment to protect workers and minimize hazards. For instance, the Occupational Safety and Health Administration (OSHA) in the United States enforces standards that require employers to provide a safe working environment. As a result, companies are increasingly investing in safety training and equipment, contributing to the market's growth. The industry's value is projected to reach 4.04 USD Billion in 2024, reflecting the heightened emphasis on compliance and safety standards.

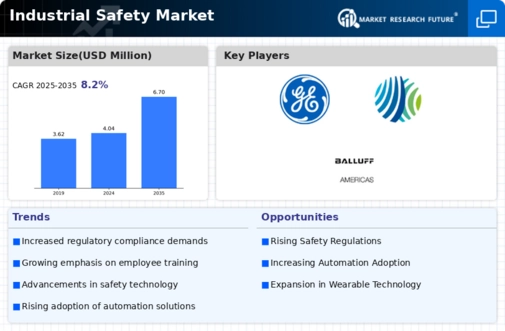

Market Growth Projections

The Global Industrial Safety Market Industry is projected to experience substantial growth over the coming years. With a market value anticipated to reach 4.04 USD Billion in 2024 and further expand to 6.7 USD Billion by 2035, the industry is poised for a robust trajectory. The compound annual growth rate (CAGR) of 4.71% from 2025 to 2035 suggests a sustained demand for safety solutions across various sectors. This growth is likely driven by increasing regulatory pressures, technological advancements, and a heightened focus on workplace safety, indicating a dynamic landscape for industrial safety.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Industrial Safety Market Industry. The integration of advanced safety equipment, such as smart helmets and wearable technology, enhances worker safety by providing real-time data and alerts. For example, sensors that detect hazardous gases or monitor fatigue levels are becoming commonplace in various industries. These advancements not only improve safety outcomes but also drive market growth as organizations seek to adopt cutting-edge solutions. The anticipated growth trajectory, with a projected market value of 6.7 USD Billion by 2035, underscores the potential of technology to revolutionize safety practices.

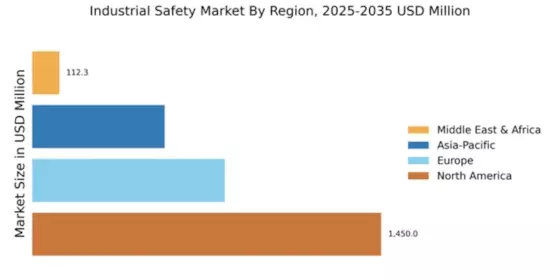

Globalization of Supply Chains

The globalization of supply chains has introduced complexities that necessitate robust safety measures, thereby influencing the Global Industrial Safety Market Industry. As companies expand their operations internationally, they encounter diverse regulatory environments and safety challenges. This has led to an increased demand for comprehensive safety solutions that can be adapted to various contexts. Organizations are investing in safety audits and compliance training to ensure adherence to local regulations. Consequently, the market is poised for growth, with projections indicating a value of 4.04 USD Billion in 2024, driven by the need for standardized safety practices across borders.

Focus on Employee Health and Well-being

The emphasis on employee health and well-being is increasingly shaping the Global Industrial Safety Market Industry. Organizations recognize that a safe work environment is integral to employee satisfaction and productivity. This realization has prompted investments in ergonomic equipment, mental health resources, and comprehensive safety training programs. By fostering a culture of safety, companies not only comply with regulations but also enhance their reputation and employee retention. The market's growth trajectory, with an expected value of 6.7 USD Billion by 2035, reflects the long-term commitment to prioritizing employee health and safety.

Increased Awareness of Workplace Safety

There is a growing awareness regarding workplace safety among organizations globally, which is a key driver for the Global Industrial Safety Market Industry. This heightened consciousness stems from various factors, including high-profile accidents and the increasing focus on employee well-being. Companies are now prioritizing safety training programs and investing in safety management systems to mitigate risks. This trend is reflected in the market's expected compound annual growth rate (CAGR) of 4.71% from 2025 to 2035, indicating a sustained commitment to enhancing safety measures across industries.