Rising Cybersecurity Threats

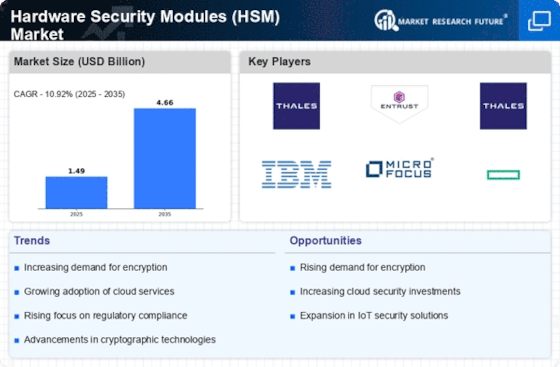

The Hardware Security Modules Market (HSM) Market is experiencing a surge in demand due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt robust security measures to protect sensitive data and maintain customer trust. According to recent data, cybercrime is projected to cost businesses trillions annually, prompting investments in HSMs as a critical component of cybersecurity infrastructure. HSMs provide a secure environment for cryptographic key management, ensuring that sensitive information remains protected against unauthorized access. As threats evolve, the need for advanced security solutions like HSMs becomes more pronounced, driving growth in the market.

Advancements in Cloud Computing

The Hardware Security Modules Market (HSM) Market is benefiting from the rapid advancements in cloud computing technologies. As organizations migrate to cloud environments, the need for secure key management solutions becomes critical. Cloud-based HSMs offer scalable and flexible security options, allowing businesses to manage cryptographic keys without the burden of on-premises infrastructure. The market for cloud services is expected to grow substantially, and with it, the demand for HSMs that can operate seamlessly in cloud environments. This trend indicates a shift towards integrated security solutions that can adapt to evolving technological landscapes.

Growing Regulatory Requirements

The Hardware Security Modules Market (HSM) Market is significantly influenced by the tightening of regulatory frameworks across various sectors. Organizations are increasingly required to comply with stringent data protection regulations, such as GDPR and PCI DSS, which mandate the use of secure cryptographic practices. HSMs play a vital role in meeting these compliance requirements by providing secure key management and cryptographic operations. The market is expected to expand as businesses prioritize compliance to avoid hefty fines and reputational damage. As regulatory scrutiny intensifies, the adoption of HSMs is likely to become a standard practice in data security strategies.

Emergence of IoT and Connected Devices

The Hardware Security Modules Market (HSM) Market is increasingly influenced by the proliferation of Internet of Things (IoT) devices. As more devices become interconnected, the need for secure communication and data protection intensifies. HSMs provide essential cryptographic capabilities that ensure the integrity and confidentiality of data transmitted between devices. The IoT market is projected to expand significantly, leading to a corresponding increase in the demand for HSMs to secure these devices. As organizations seek to mitigate risks associated with IoT deployments, the adoption of HSMs is likely to rise, highlighting their importance in modern security architectures.

Increased Demand for Digital Payment Solutions

The Hardware Security Modules Market (HSM) Market is witnessing growth driven by the rising demand for secure digital payment solutions. With the proliferation of e-commerce and mobile payment platforms, the need for secure transaction processing has become paramount. HSMs are essential for safeguarding payment data and ensuring secure cryptographic operations during transactions. The market for digital payments is projected to reach trillions in the coming years, further propelling the adoption of HSMs. As businesses seek to enhance customer trust and secure payment information, the integration of HSMs into payment systems is likely to become increasingly prevalent.