Rising Industrial Demand

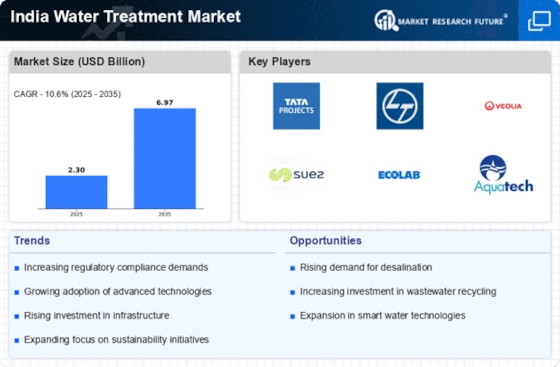

The India Water Treatment Market is poised for growth due to the rising demand from various industrial sectors. Industries such as textiles, pharmaceuticals, and food processing require high-quality water for their operations, leading to an increased focus on water treatment solutions. Reports indicate that the industrial segment accounts for a substantial share of the overall water treatment market, with projections suggesting a compound annual growth rate of over 10% in the coming years. This trend is likely to drive innovation in treatment technologies, as industries seek to optimize water usage and comply with environmental regulations. Consequently, the market is expected to evolve, offering diverse solutions tailored to specific industrial needs.

Increasing Water Scarcity

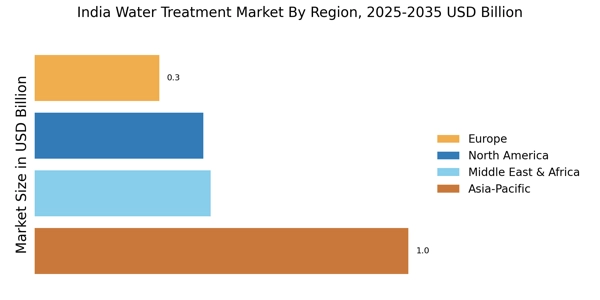

The India Water Treatment Market is experiencing a surge in demand due to increasing water scarcity across various regions. Rapid urbanization and industrialization have exacerbated the depletion of freshwater resources, leading to a pressing need for effective water treatment solutions. According to recent estimates, nearly 600 million people in India face high to extreme water stress, which underscores the urgency for advanced treatment technologies. This scarcity not only affects domestic water supply but also impacts agricultural productivity, prompting both government and private sectors to invest in innovative water treatment systems. As a result, the industry is likely to witness substantial growth as stakeholders seek to address these challenges through sustainable water management practices.

Technological Innovations

The India Water Treatment Market is witnessing a wave of technological innovations that are transforming traditional water treatment processes. Advancements in membrane filtration, UV disinfection, and advanced oxidation processes are enhancing the efficiency and effectiveness of water treatment systems. These technologies not only improve water quality but also reduce operational costs, making them attractive to both consumers and industries. The integration of IoT and smart technologies in water treatment systems is also gaining traction, enabling real-time monitoring and management of water resources. As these innovations continue to emerge, they are likely to play a pivotal role in shaping the future of the India Water Treatment Market, driving growth and sustainability.

Growing Awareness of Water Quality

The India Water Treatment Market is increasingly influenced by the growing awareness of water quality among consumers and businesses. With rising concerns over waterborne diseases and pollution, there is a heightened demand for effective water treatment solutions. Public awareness campaigns and educational initiatives are fostering a culture of health consciousness, prompting individuals to invest in home water treatment systems. Additionally, businesses are recognizing the importance of maintaining high water quality standards to ensure compliance with regulations and enhance their brand reputation. This shift in consumer behavior is likely to propel the market forward, as stakeholders seek reliable and efficient water treatment options to safeguard public health and the environment.

Government Initiatives and Policies

The India Water Treatment Market is significantly influenced by various government initiatives aimed at improving water quality and accessibility. The Indian government has launched several programs, such as the National Water Policy and the Jal Jeevan Mission, which focus on providing safe drinking water to all citizens. These initiatives are expected to drive investments in water treatment infrastructure, thereby enhancing the market landscape. Furthermore, the government is likely to implement stricter regulations on wastewater management, compelling industries to adopt advanced treatment technologies. This regulatory framework not only promotes public health but also encourages private sector participation, creating a conducive environment for market expansion.