Top Industry Leaders in the India Water Treatment Market

India Water Treatment Market

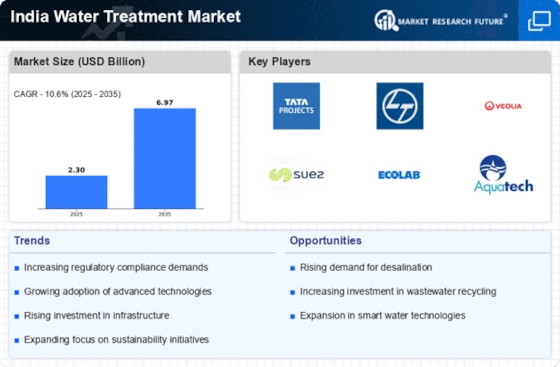

The market encompasses a wide range of technologies and solutions aimed at purifying water from various sources, including groundwater, surface water, and wastewater. Key treatment processes include filtration, disinfection, desalination, and membrane technologies. India's rapidly expanding population and industrial activities are amplifying the need for efficient water treatment solutions.

Market Players and Strategies:

The Indian water treatment market is a blend of established multinational corporations and domestic players. Here are some key players and their strategies:

-

Multinational Corporations (MNCs): These companies, like Ecolab, Veolia, and Evoqua, leverage their global expertise and technological advancements. They often focus on large-scale projects and cater to industrial clients with complex water treatment needs. Their strategies involve:

-

Mergers and Acquisitions (M&As): Acquiring local players to expand reach and gain market share. -

Technology Leadership: Investing heavily in research and development (R&D) to offer cutting-edge water treatment solutions. -

Strategic Partnerships: Collaborating with Indian companies for better market access and distribution networks.

-

-

Domestic Players: These companies, like VA Tech Wabag and Ion Exchange India, possess strong local knowledge and cater to a wider range of clients, including residential and municipal sectors. Their strategies include:

-

Cost-Effectiveness: Offering solutions that are economical and well-suited to Indian budgets. -

Product Diversification: Developing a broader product portfolio catering to diverse water treatment needs. -

Focus on After-Sales Service: Providing reliable after-sales service and maintenance support to build customer loyalty.

-

Factors Affecting Market Share:

Several factors influence a company's market share in the Indian water treatment market:

-

Technology and Innovation: Offering advanced water treatment solutions like membrane filtration and desalination technologies can give companies an edge. -

Project Expertise: The ability to handle complex water treatment projects efficiently and deliver on time is crucial. -

Service Network: Having a robust service network across India is essential for prompt installation, maintenance, and customer support. -

Government Regulations: Companies that can adapt their solutions to comply with evolving government regulations on water quality and effluent discharge gain an advantage. -

Price Competitiveness: Finding the right balance between offering high-quality solutions and maintaining competitive pricing is vital.

Key Companies in the Water Treatment Market include

- Ecolab Inc.

- Veolia Group

- Aquatech International Corporation

- Calgon Carbon Corporation

- Evoqua Water Technologies LLC

Toshiba Water Solutions Private Limited - VA Tech Wabag.

Recent News

In November 2022, WABAG LTD inked an agreement with the Asian Development Bank (ADB) to fund INR 200 crores (USD 24.6 million) through unlisted Non-Convertible Debentures with tenors of five years and three months. ADB will subscribe to it for its water treatment business for a 12-month period.

In August 2022, Huliot Pipes, an Israeli firm, created the ClearBlack Sewage Treatment Plant, which is designed for the Indian market to recover and reuse wastewater.

December 2023: Ecolab Inc., a major MNC, announced the launch of its new water treatment technology specifically designed for industrial applications in India. This move reflects the focus of MNCs on developing solutions tailored to the Indian market.

January 2024: The Indian government released stricter regulations on industrial effluent discharge. This is expected to drive demand for advanced wastewater treatment technologies in the coming years.

February 2024: Ion Exchange (India) Ltd., a prominent domestic player, announced a collaboration with a foreign company to develop innovative membrane filtration technologies for water treatment. This collaboration highlights the growing trend of partnerships and joint ventures in the water treatment sector