Research Methodology on Water Treatment Chemicals Market

1. Introduction

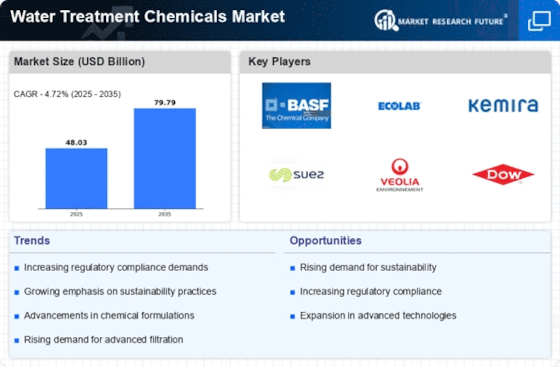

The purpose of this research report is to examine the global water treatment chemicals market focusing on the size, growth, segmentation, and trends related to products and services offered. This report studies the current and future scenarios of the global water treatment chemicals market. It provides a detailed overview of major drivers, restraints, opportunities, and challenges that shape the market and their impact on the forecast period 2023 to 2030.

2. Research Scope and Objectives

The scope of this research project is to investigate the market size and growth potential of the global water treatment chemicals market and identify the segments, global regions, and countries that are part of this market. The research objectives are outlined below:

- Establish global market size and growth rate of the global water treatment chemicals market

- Analyze the segments of the global water treatment chemicals market

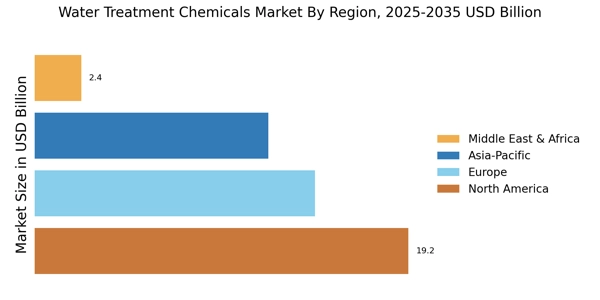

- Identify regional markets that contribute the most to the growth of the global water treatment chemicals market

3. Research Methodology

3.1 Primary Resources

The primary sources used to collect data and information for this report include manufacturers, distributors, retailers, and suppliers of water treatment chemicals, as well as industry associations, investment banks, and market research firms. Substantial time and effort have been dedicated to ensuring that only reliable and accurate data and information are used in this report.

3.2 Market Research Process

The market research process is conducted in four stages: literature review, primary research & data collection, data analysis & modelling, and finally market forecasting & trends.

4. Literature Review

The literature review phase involves researching widely available sources and gleaning industry insights from published research reports, press releases, and expert interviews. Sources such as the World Bank, International Monetary Fund, World Trade Organization, International Labour Organization, Association of Water Quality of America, European Water Association, The Chlorine Institute and other relevant international organizations were consulted to gain insights into trends, patterns and challenges that face the global water treatment chemicals market.

5. Primary Research & Data Collection

In this phase, the primary data sources are used to get information about key market and industry trends related to the global water treatment chemicals market and are done by conducting market surveys, interviews with industry experts, and primary research with the key stakeholders in the industry. The data collected is then compiled, evaluated and verified by the research team.

6. Data Analysis & Modelling

The collected data is then analyzed and modelled using advanced statistical and analytical tools such as PESTLE, SWOT, regression analysis and market simulation. These analyses provide insights into market dynamics such as drivers and restraints.

7. Market Forecasting & Trends

Finally, the historical data and the evaluated market data are used to compute the current and future market growth forecasts. The trends and forecasts derived from this analysis will be crucial for decision-making and industry planning.

8. Conclusion

The research project follows a data-driven approach and uses industry-standard methods for the in-depth analysis of the global water treatment chemicals market. The research methodology used provides a holistic view of the current and future status of the global water treatment chemicals market.