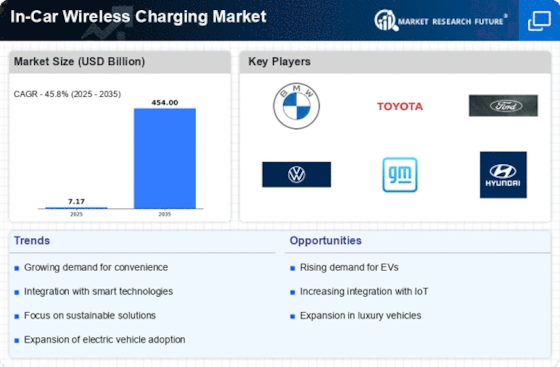

Consumer Preference for Convenience

Consumer preference for convenience is a significant driver of the In-Car Wireless Charging Market. As lifestyles become increasingly fast-paced, the demand for hassle-free charging solutions is on the rise. Wireless charging eliminates the need for cables and connectors, allowing users to charge their devices effortlessly while on the go. Surveys indicate that over 70% of consumers express a preference for wireless charging options in their vehicles, highlighting a clear market trend. This shift in consumer behavior suggests that automakers are likely to prioritize the integration of wireless charging systems in their new models. Consequently, the In-Car Wireless Charging Market is expected to expand as manufacturers respond to this growing demand for convenience and user-friendly technology.

Rising Demand for Electric Vehicles

The increasing adoption of electric vehicles (EVs) is a pivotal driver for the In-Car Wireless Charging Market. As consumers shift towards EVs, the need for convenient charging solutions becomes paramount. In 2025, it is estimated that the number of electric vehicles on the road will surpass 30 million, creating a substantial market for in-car wireless charging systems. This trend suggests that manufacturers are likely to invest in wireless charging technology to enhance user experience and meet consumer expectations. Furthermore, the integration of wireless charging in EVs aligns with the broader trend of technological innovation in the automotive sector, potentially leading to a more seamless driving experience. As such, the In-Car Wireless Charging Market is poised to benefit significantly from the growing electric vehicle segment.

Government Initiatives and Regulations

Government initiatives and regulations aimed at promoting electric mobility and sustainable transportation are influencing the In-Car Wireless Charging Market. Various countries are implementing policies that encourage the adoption of electric vehicles, which in turn drives the need for efficient charging solutions. For instance, incentives for EV purchases and investments in charging infrastructure are becoming more prevalent. These initiatives not only support the growth of the electric vehicle market but also create a favorable environment for the development of wireless charging technologies. As governments continue to push for greener transportation options, the In-Car Wireless Charging Market is likely to experience accelerated growth, as manufacturers align their strategies with regulatory frameworks and consumer expectations.

Integration with Smart Vehicle Systems

The integration of in-car wireless charging systems with smart vehicle technologies is emerging as a key driver for the In-Car Wireless Charging Market. As vehicles become increasingly connected, the demand for seamless integration of charging solutions with infotainment and navigation systems is growing. This integration allows for features such as automatic device recognition and optimized charging based on user preferences. Furthermore, the rise of autonomous vehicles is expected to further enhance the relevance of wireless charging, as these vehicles may require efficient charging solutions to support their operational needs. As automakers invest in smart technologies, the In-Car Wireless Charging Market is likely to benefit from this trend, leading to innovative charging solutions that cater to the evolving landscape of automotive technology.

Technological Advancements in Wireless Charging

Technological advancements play a crucial role in shaping the In-Car Wireless Charging Market. Innovations in charging efficiency, speed, and compatibility are driving consumer interest and adoption. Recent developments indicate that wireless charging systems can now deliver power levels comparable to traditional wired chargers, with some systems achieving up to 15 watts. This improvement not only enhances user convenience but also addresses concerns regarding charging time. Moreover, the integration of smart technology, such as app connectivity and real-time charging status updates, further elevates the user experience. As these technologies continue to evolve, the In-Car Wireless Charging Market is likely to witness increased investment and growth, as manufacturers strive to offer cutting-edge solutions that meet the demands of tech-savvy consumers.