In-Flight Catering Service Market Summary

As per Market Research Future analysis, the In-flight Catering Services Market Size was estimated at 20.19 USD Billion in 2024. The In-flight Catering Services industry is projected to grow from 22.07 USD Billion in 2025 to 53.7 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 9.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The In-flight Catering Services Market is experiencing a dynamic shift towards health-conscious and sustainable offerings.

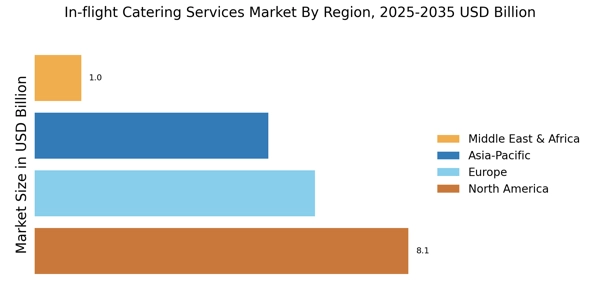

- North America remains the largest market for in-flight catering services, driven by high passenger volumes and diverse culinary preferences.

- The Asia-Pacific region is emerging as the fastest-growing market, reflecting increasing air travel and evolving consumer tastes.

- First Class continues to dominate in terms of market share, while Business Class is witnessing rapid growth due to rising demand for premium services.

- Key market drivers include rising passenger expectations for quality and the focus on sustainability initiatives in food preparation.

Market Size & Forecast

| 2024 Market Size | 20.19 (USD Billion) |

| 2035 Market Size | 53.7 (USD Billion) |

| CAGR (2025 - 2035) | 9.3% |

Major Players

Gate Gourmet (CH), LSG Sky Chefs (DE), SATS Ltd (SG), Flying Food Group (US), Air Chef (IN), Servair (FR), Do & Co (AT), Royal Inflight Catering (AE), Sky Gourmet (DE)