Regulatory Compliance

Regulatory compliance is becoming increasingly critical for the High-Density Polyethylene Market. Governments worldwide are implementing stringent regulations regarding plastic usage and waste management. These regulations often mandate the use of recyclable materials and impose penalties for non-compliance. As a result, manufacturers are compelled to adapt their production processes and product offerings to meet these regulatory standards. The emphasis on compliance not only affects operational practices but also influences product design and marketing strategies. Companies that proactively align with regulatory requirements are likely to gain a competitive advantage in the High-Density Polyethylene Market, as they can better cater to environmentally conscious consumers and avoid potential legal repercussions.

Innovative Applications

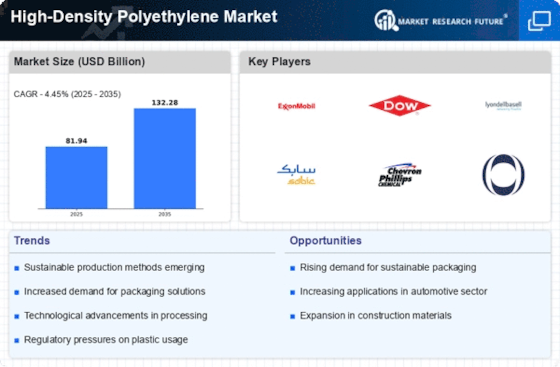

Innovative applications of High-Density Polyethylene Market are driving growth within the market. The versatility of HDPE allows it to be utilized in a wide range of sectors, including packaging, agriculture, and construction. Recent developments have led to the creation of specialized HDPE products, such as geotextiles and high-performance containers, which cater to specific industry needs. The increasing focus on lightweight and durable materials is further propelling the adoption of HDPE in various applications. By 2025, the market is expected to see a rise in demand for these innovative applications, as industries seek to enhance efficiency and reduce costs. This trend indicates that the High-Density Polyethylene Market is poised for continued expansion as new applications emerge.

Sustainability Initiatives

The High-Density Polyethylene Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, manufacturers are compelled to adopt eco-friendly practices. This includes the development of recyclable HDPE products and the implementation of sustainable production processes. The market is witnessing a shift towards bio-based HDPE, which is derived from renewable resources. This transition not only meets consumer demand for sustainable products but also aligns with regulatory frameworks aimed at reducing plastic waste. In 2025, the market for recycled HDPE is projected to grow significantly, driven by both consumer preferences and legislative pressures. Companies that prioritize sustainability are likely to enhance their competitive edge in the High-Density Polyethylene Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the High-Density Polyethylene Market. Innovations in production techniques, such as advanced polymerization processes, have led to the creation of HDPE with enhanced properties. These advancements enable manufacturers to produce lighter, stronger, and more durable products, which are increasingly sought after in various applications. The integration of automation and digital technologies in manufacturing processes is also streamlining operations, reducing costs, and improving efficiency. As a result, the market is expected to witness a surge in the adoption of high-performance HDPE products. By 2025, the impact of these technological innovations is anticipated to be profound, potentially reshaping competitive dynamics within the High-Density Polyethylene Market.

Rising Demand in Emerging Markets

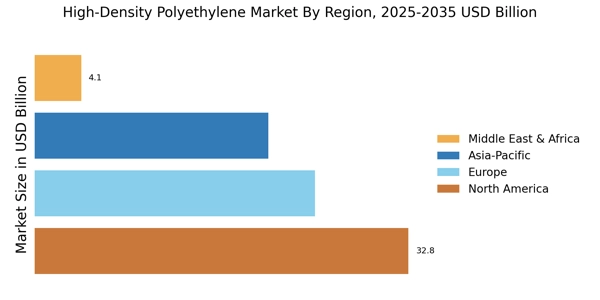

The High-Density Polyethylene Market is experiencing a notable increase in demand from emerging markets. Rapid urbanization and industrialization in regions such as Asia-Pacific and Latin America are driving the consumption of HDPE in various sectors, including packaging, construction, and automotive. In 2025, the demand for HDPE in these regions is projected to rise significantly, fueled by the growing population and increasing disposable incomes. Additionally, the expansion of infrastructure projects and the rise of e-commerce are further propelling the need for HDPE products. This trend suggests that companies focusing on these emerging markets may find lucrative opportunities within the High-Density Polyethylene Market.