Rising Demand in Packaging

The rising demand in packaging significantly impacts the Low-density Polyethylene Market. With the expansion of e-commerce and retail sectors, the need for efficient and durable packaging solutions is on the rise. Low-density polyethylene is favored for its lightweight, flexibility, and moisture resistance, making it ideal for various packaging applications. In 2025, the packaging segment is projected to account for a substantial share of the market, driven by consumer preferences for convenience and product protection. Additionally, the trend towards single-use packaging solutions further propels the demand for low-density polyethylene. This growing reliance on low-density polyethylene in packaging is likely to bolster the overall market dynamics.

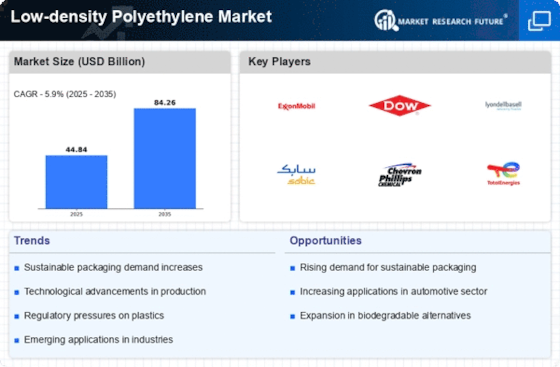

Sustainability Initiatives

The Low-density Polyethylene Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, manufacturers are under pressure to adopt eco-friendly practices. This shift is evident in the growing demand for recyclable and biodegradable materials. In 2025, the market is projected to witness a significant increase in the production of sustainable low-density polyethylene products. Companies are investing in research and development to create alternatives that minimize environmental impact. This trend not only aligns with consumer preferences but also complies with stringent regulations aimed at reducing plastic waste. The emphasis on sustainability is likely to drive innovation within the Low-density Polyethylene Market, fostering a competitive landscape where eco-conscious products gain traction.

Technological Advancements

Technological advancements play a pivotal role in shaping the Low-density Polyethylene Market. Innovations in production processes, such as advanced polymerization techniques, enhance the efficiency and quality of low-density polyethylene. These advancements enable manufacturers to produce materials with improved properties, catering to diverse applications. In 2025, the market is expected to benefit from the integration of automation and smart technologies, streamlining operations and reducing costs. Furthermore, the development of high-performance low-density polyethylene grades is anticipated to expand its application scope, particularly in sectors like automotive and construction. As technology continues to evolve, the Low-density Polyethylene Market is likely to experience enhanced competitiveness and growth opportunities.

Growth in Consumer Goods Sector

The growth in the consumer goods sector is a significant driver for the Low-density Polyethylene Market. As disposable income rises, consumers are increasingly purchasing packaged goods, which in turn fuels the demand for low-density polyethylene. This material is widely used in the production of containers, bags, and other packaging solutions that cater to consumer preferences for convenience and portability. In 2025, the consumer goods sector is expected to continue its upward trajectory, further enhancing the demand for low-density polyethylene products. The versatility and cost-effectiveness of low-density polyethylene make it a preferred choice among manufacturers, thereby contributing to the overall growth of the Low-density Polyethylene Market.

Regulatory Support for Plastic Alternatives

Regulatory support for plastic alternatives is emerging as a crucial driver in the Low-density Polyethylene Market. Governments are increasingly implementing policies aimed at reducing plastic waste and promoting sustainable materials. This regulatory landscape encourages manufacturers to explore low-density polyethylene as a viable alternative to traditional plastics. In 2025, the market is likely to benefit from incentives and subsidies aimed at promoting the use of low-density polyethylene in various applications. Such support not only fosters innovation but also aligns with global sustainability goals. As regulations evolve, the Low-density Polyethylene Market is expected to adapt, potentially leading to increased market share and new opportunities for growth.