Growth in Construction Activities

The construction sector is a significant driver for the High Density Polyethylene Hdpe Resin Market, as HDPE is increasingly utilized in various applications such as piping, geomembranes, and insulation. The material's resistance to corrosion and chemicals makes it an ideal choice for infrastructure projects. In recent years, the construction industry has seen a resurgence, with investments in residential and commercial projects rising. This trend is expected to continue, with HDPE usage in construction projected to grow by approximately 5% annually through 2025. As urbanization accelerates, the demand for durable and efficient construction materials like HDPE resin is likely to expand, further solidifying its market position.

Rising Demand in Packaging Sector

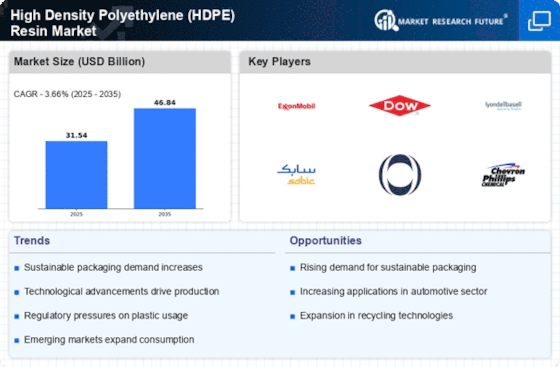

The High Density Polyethylene Hdpe Resin Market is experiencing a notable surge in demand, particularly from the packaging sector. This is largely attributed to the material's excellent barrier properties, which enhance product shelf life and safety. In 2025, the packaging segment is projected to account for over 30% of the total market share, driven by the increasing need for lightweight and durable packaging solutions. Furthermore, the shift towards sustainable packaging options is prompting manufacturers to adopt HDPE due to its recyclability and lower environmental impact. As consumer preferences evolve towards eco-friendly products, the packaging industry's reliance on HDPE resin is likely to intensify, thereby propelling market growth.

Technological Innovations in Production

Technological advancements in the production processes of High Density Polyethylene Hdpe Resin Market are playing a crucial role in enhancing efficiency and reducing costs. Innovations such as advanced catalytic processes and improved polymerization techniques are enabling manufacturers to produce HDPE with superior properties and lower energy consumption. These developments not only enhance product quality but also contribute to sustainability by minimizing waste and emissions. As production technologies evolve, the market is likely to witness a shift towards more efficient and environmentally friendly manufacturing practices, which could attract new investments and drive market growth in the coming years.

Increasing Applications in Automotive Sector

The automotive industry is emerging as a significant consumer of High Density Polyethylene Hdpe Resin Market, driven by the material's lightweight and durable characteristics. HDPE is increasingly used in various automotive components, including fuel tanks, interior parts, and exterior panels. The push for fuel efficiency and reduced emissions is prompting manufacturers to seek lightweight materials, making HDPE an attractive option. As the automotive sector continues to innovate and prioritize sustainability, the demand for HDPE in vehicle production is expected to rise, potentially increasing its market share in this sector by 4% annually through 2025.

Regulatory Support for Recycling Initiatives

Regulatory frameworks promoting recycling and sustainability are significantly influencing the High Density Polyethylene Hdpe Resin Market. Governments are increasingly implementing policies that encourage the use of recycled materials in manufacturing processes. This regulatory support is fostering a favorable environment for HDPE, as it is one of the most widely recycled plastics. In 2025, it is anticipated that recycled HDPE will constitute a larger portion of the market, driven by both consumer demand for sustainable products and legislative mandates. As these initiatives gain traction, the market for HDPE resin is likely to expand, aligning with global sustainability goals.