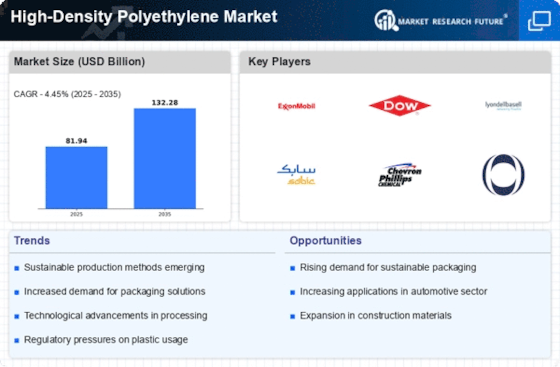

Top Industry Leaders in the High-Density Polyethylene Market

High-Density Polyethylene (HDPE), the stalwart champion of the plastics world, is experiencing a surge in demand thanks to its unrivaled combination of strength, durability, and versatility. From pipes and bottles to containers and construction materials, HDPE finds its way into countless applications, driving a dynamic and competitive market landscape.

Market Share: A Balancing Act on a Polymer Chain

Several factors influence who gets the lion's share in this intricate market:

-

Application Scope: The market spans diverse segments like packaging, piping, construction, automotive, and consumer goods. Each segment has its specific needs, influencing HDPE grade selection and market dynamics. -

Geographical Distribution: Asia Pacific currently leads the charge, driven by rapid urbanization and industrialization. However, North America and Europe remain prominent players, with mature markets and high demand for specialized HDPE applications. -

Raw Material Prices: Fluctuations in the price of crude oil, the primary feedstock for HDPE, directly impact production costs and market stability. -

Environmental Regulations: Stringent regulations on plastic waste and increasing pressure for sustainable production practices are driving innovation in recycling and bio-based HDPE alternatives. -

Player Strategies: From established petrochemical giants like ExxonMobil and Dow to niche players specializing in sustainable solutions, the market boasts a diverse range of competitors. Their strategies range from product diversification and technological advancements to sustainability initiatives and strategic partnerships.

Strategic Maneuvers: Securing a Foothold in the HDPE Arena

Players in the HDPE market are wielding their polymer expertise to secure their share:

-

Product Innovation: Developing new HDPE grades with enhanced properties like improved chemical resistance, higher heat tolerance, and lighter weight caters to evolving demands and differentiates players from the competition. -

Sustainability Focus: Highlighting the eco-friendly aspects of recyclable and bio-based HDPE, such as their reduced environmental footprint and potential for closed-loop recycling, resonates with environmentally conscious consumers and aligns with green regulations. -

Technological Advancements: Implementing advanced polymerization technologies and processing techniques leads to more efficient production processes, reduces material waste, and opens up possibilities for novel applications. -

Market Expansion: Entering new geographical markets or expanding existing footprints in high-growth regions like Southeast Asia and Latin America fuels market share growth. -

Strategic Partnerships: Collaborating with raw material suppliers, recycling companies, and research institutions fosters innovation and opens up new avenues for product development and market reach.

Key Players:

-

Dow

-

Exxon Mobil Corporation

-

INEOS

-

SABIC

-

LyondellBasell Industries Holdings BV

-

LOTTE Chemical Corporation

-

Borealis AG

-

PetroChina Company Limited

-

Abu Dhabi Polymers Company Ltd.

-

Formosa Plastics Corp.

-

Braskem S.A

-

Chevron Phillips Chemical Co.

Recent Developments:

August 2023: Dow Chemical, a leading HDPE producer, announces plans to invest in a new production facility in India to cater to the rising demand in the Asian market.

September 2023: The Ellen MacArthur Foundation launches a new initiative calling for a global treaty on plastic pollution, potentially impacting the production and use of HDPE.

October 2023: SABIC unveils a new line of bio-based HDPE made from wood waste, offering a sustainable alternative for the construction industry.

November 2023: Researchers at MIT develop a new catalyst that significantly reduces the energy required to produce HDPE, potentially lowering production costs and environmental impact.

December 2023: Unilever, a major consumer goods company, announces a commitment to using 100% recycled plastics in its packaging by 2025, boosting demand for recycled HDPE in the packaging industry.