Increasing Applications in Agriculture

The agricultural sector is emerging as a significant driver for the High Density Polyethylene (Hdpe) Film Market. HDPE films are extensively used in agricultural applications, including greenhouse covers, mulch films, and silage bags. These films provide essential benefits such as UV protection, moisture retention, and enhanced crop yield. As the global population continues to rise, the demand for efficient agricultural practices is becoming more pronounced. In 2025, the agricultural application of HDPE films is anticipated to witness substantial growth, driven by the need for sustainable farming solutions. This trend not only supports food security but also positions HDPE films as a vital component in the agricultural landscape, thereby bolstering the High Density Polyethylene (Hdpe) Film Market.

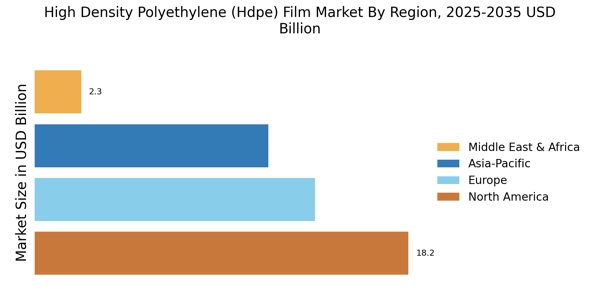

Growth in E-Commerce and Retail Sectors

The expansion of e-commerce and retail sectors is significantly influencing the High Density Polyethylene (Hdpe) Film Market. As online shopping continues to gain traction, the demand for packaging solutions that ensure product safety and integrity during transit is paramount. HDPE films are increasingly utilized for their durability and protective qualities, making them ideal for packaging a wide range of products. In 2025, the e-commerce sector is expected to contribute substantially to the overall packaging market, with HDPE films playing a crucial role in meeting the packaging needs of various industries. This growth in e-commerce not only boosts the demand for HDPE films but also encourages innovation in packaging solutions within the High Density Polyethylene (Hdpe) Film Market.

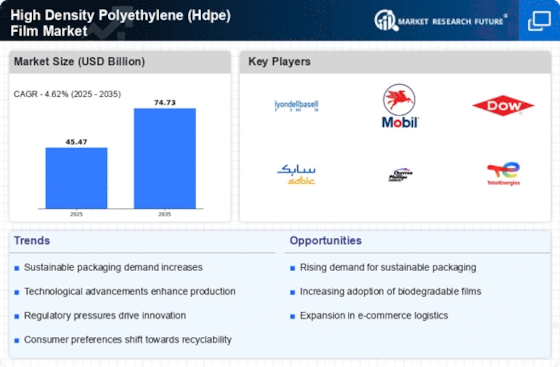

Rising Demand for Eco-Friendly Packaging

The increasing emphasis on sustainability is driving the High Density Polyethylene (Hdpe) Film Market. As consumers become more environmentally conscious, there is a notable shift towards eco-friendly packaging solutions. This trend is reflected in the growing demand for biodegradable and recyclable materials, with HDPE films being favored for their recyclability. In 2025, the market for sustainable packaging is projected to reach substantial figures, indicating a robust growth trajectory. Companies are increasingly adopting HDPE films to meet regulatory requirements and consumer preferences, thereby enhancing their market position. The shift towards sustainable practices not only aligns with consumer values but also offers companies a competitive edge in the High Density Polyethylene (Hdpe) Film Market.

Regulatory Support for Plastic Alternatives

Regulatory frameworks promoting the use of alternative materials are influencing the High Density Polyethylene (Hdpe) Film Market. Governments are increasingly implementing policies aimed at reducing plastic waste and encouraging the adoption of recyclable materials. HDPE films, known for their recyclability, are positioned favorably within these regulatory environments. As legislation evolves, companies are likely to seek compliance by integrating HDPE films into their packaging strategies. This regulatory support not only drives demand for HDPE films but also fosters innovation in sustainable packaging solutions. The alignment of industry practices with regulatory expectations is expected to enhance the growth prospects of the High Density Polyethylene (Hdpe) Film Market.

Technological Innovations in Film Production

Technological advancements in film production are reshaping the High Density Polyethylene (Hdpe) Film Market. Innovations such as improved extrusion techniques and enhanced polymer formulations are leading to the development of high-performance HDPE films. These advancements result in films that offer superior strength, clarity, and barrier properties, catering to diverse applications across various sectors. The introduction of smart packaging technologies, which integrate sensors and indicators, is also gaining traction. As manufacturers adopt these technologies, the efficiency and quality of HDPE films are expected to improve, thereby driving market growth. The ongoing research and development efforts in film production technology are likely to create new opportunities within the High Density Polyethylene (Hdpe) Film Market.