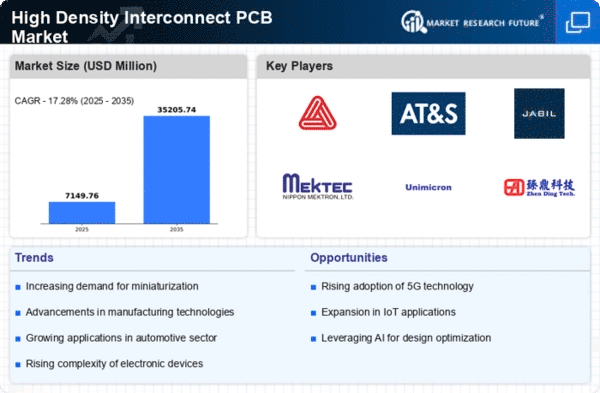

Market Growth Projections

The Global High Density Interconnect PCB Market Industry is poised for remarkable growth, with projections indicating a rise from 6.1 USD Billion in 2024 to an impressive 35.2 USD Billion by 2035. This trajectory reflects the increasing reliance on high-density interconnect technologies across various sectors, including telecommunications, automotive, and consumer electronics. The anticipated compound annual growth rate of 17.28% from 2025 to 2035 underscores the industry's potential for expansion. As businesses and consumers alike seek more efficient and compact electronic solutions, the demand for high-density interconnect PCBs is likely to escalate, driving innovation and investment in this critical sector.

Advancements in Technology

Technological advancements play a crucial role in shaping the Global High Density Interconnect PCB Market Industry. Innovations in materials, such as high-frequency laminates and advanced substrate technologies, enable the production of PCBs that support faster signal transmission and improved thermal management. These advancements are particularly relevant in sectors like automotive and aerospace, where reliability and performance are critical. As the industry evolves, the integration of smart technologies and IoT devices further propels the demand for high-density interconnect solutions. The market is expected to witness a compound annual growth rate of 17.28% from 2025 to 2035, indicating a robust trajectory driven by these technological enhancements.

Surge in Consumer Electronics

The consumer electronics sector is a primary driver of the Global High Density Interconnect PCB Market Industry, as the proliferation of smart devices continues unabated. Products such as tablets, wearables, and smart home devices necessitate PCBs that can deliver high performance in compact designs. This demand is reflected in the market's anticipated growth, with a valuation of 6.1 USD Billion expected in 2024. The trend towards smart technology adoption, coupled with consumer preferences for multifunctional devices, propels manufacturers to innovate and enhance PCB capabilities. As a result, the industry is likely to see sustained growth as it adapts to the evolving landscape of consumer electronics.

Growth in Automotive Electronics

The automotive sector significantly influences the Global High Density Interconnect PCB Market Industry, driven by the increasing complexity of electronic systems in vehicles. Modern automobiles incorporate advanced driver-assistance systems, infotainment, and connectivity features, all of which require sophisticated PCB solutions. As electric vehicles gain traction, the demand for high-density interconnect PCBs is expected to rise, given their ability to support the intricate electronic architectures of these vehicles. The market's expansion is further underscored by projections indicating a growth to 35.2 USD Billion by 2035, highlighting the automotive industry's pivotal role in shaping future PCB requirements.

Rising Demand for Miniaturization

The Global High Density Interconnect PCB Market Industry experiences a notable surge in demand for miniaturization across various sectors, particularly in consumer electronics and telecommunications. As devices become increasingly compact, the need for PCBs that can accommodate higher component densities without compromising performance becomes paramount. This trend is exemplified by the smartphone industry, where manufacturers continuously strive to integrate more features into smaller form factors. The market is projected to reach 6.1 USD Billion in 2024, reflecting the industry's adaptation to these evolving consumer preferences. The push for miniaturization is likely to drive innovation in PCB design and manufacturing processes.

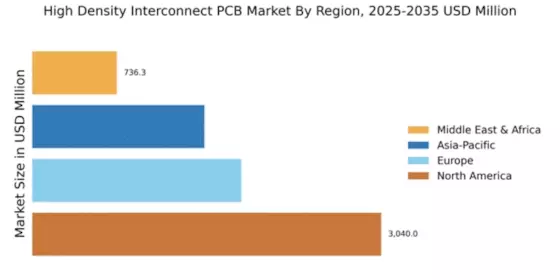

Emerging Markets and Global Expansion

Emerging markets present substantial opportunities for the Global High Density Interconnect PCB Market Industry, as economic development fosters increased demand for electronic products. Countries in Asia-Pacific and Latin America are witnessing rapid urbanization and rising disposable incomes, leading to greater consumption of consumer electronics and automotive technologies. This trend is likely to drive the need for high-density interconnect solutions, as manufacturers seek to establish a foothold in these burgeoning markets. The anticipated growth trajectory, with a CAGR of 17.28% from 2025 to 2035, suggests that the industry will continue to expand its global presence, adapting to the unique demands of diverse markets.