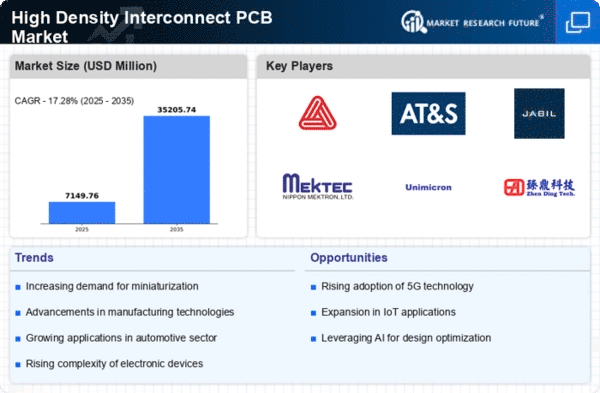

Market Share

High Density Interconnect PCB Market Share Analysis

As mobile phones become increasingly sophisticated, the need for compact and powerful motherboards has grown. Any-layer HDI (high-density interconnect) PCBs offer a promising solution, with their ability to accommodate more stack-ups, smaller line spacing, and a greater number of functional modules. With the advancements in 5G technology and the demand for improved signal transmission, mobile phone manufacturers are constantly upgrading their motherboards. In the near future, ordinary 5G phones will likely require at least 8-12 layers of 4-stage HDI motherboards, while high-end flagship phones may directly adopt 14-layer 5-stage or higher HDI motherboards.

Flex HDI PCBs present a unique approach to circuit board design, integrating multiple PCB assemblies without the need for wires, cables, or connectors. Instead, they utilize thin, lightweight composites that embed wiring in ultra-thin, flexible ribbons between sections. This innovative design offers several advantages, including reduced weight, improved flexibility, and enhanced durability.

Flex-rigid PCB packaging combines the strengths of both flex and rigid PCBs, creating a versatile solution for a wide range of applications. The flexible circuit substrate serves as a backbone for wiring, while rigid multilayer circuit sections are built up as modules where necessary. Flex-rigid PCBs offer superior vibration resistance, compact size, high tensile strength, and the ability to bend up to 360 degrees, making them well-suited for harsh environments.

Multilayer HDI PCBs are another promising technology, providing the power of a double-layer PCB in a fraction of the size. Available in variants ranging from four to twelve layers, they offer flexibility in size and thickness. While even layers are generally preferred due to their superior performance and lower cost compared to odd layers, the actual number of layers required depends on the specific application. For most applications, four to eight layers are sufficient, while some professional PCB manufacturers can produce multilayer PCBs with up to 100 layers.

In conclusion, the demand for advanced PCB technologies is expected to continue growing as the electronics industry strives for smaller, more powerful, and more versatile devices. Any-layer HDI PCBs, flex HDI PCBs, and multilayer HDI PCBs each offer unique advantages and are poised to play significant roles in the future of electronics.

Leave a Comment