Top Industry Leaders in the High Density Interconnect PCB Market

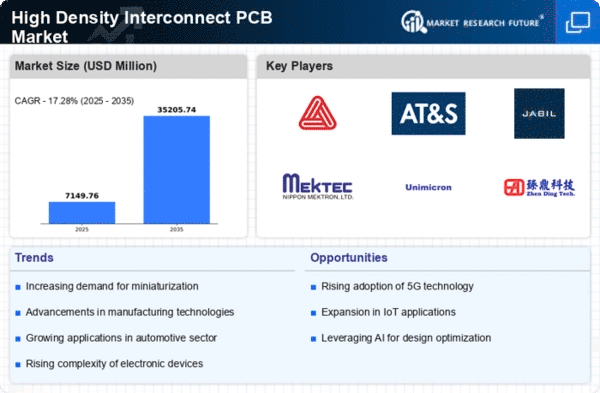

A Competitive Landscape of High-Density Interconnect PCB Market:

The high-density interconnect (HDI) PCB market pulsates with the rhythm of miniaturization and complexity in electronics. These miniature marvels, packing numerous layers and intricate traces into tight spaces, serve as the backbone of modern devices, from smartphones and wearables to advanced medical equipment and high-performance computing systems. The HDI PCB market is a fertile ground for established giants and ambitious newcomers alike.

Some of the High-Density Interconnect PCB companies listed below:

- Unimicron, Epec, LLC

- TTM Technologies Inc.

- RayMing Technology

- HiTech Circuits

- NCAB Group Corporation

- Millennium Circuits Limited

- Tripod Technology

- Zhen Ding Tech. Group Technology Holding Limited

- AKM Meadville

- Meiko Electronics Co., Ltd.

- Sierra Circuits Inc.

Strategies adopted by key players:

The battle for market share is waged on multiple fronts. Innovation remains paramount, with players investing heavily in research and development, focusing on finer trace widths, improved blind and buried vias, and advanced materials like high-performance resins and low-loss laminates.

Cost optimization is another key weapon. Asian players are adept at streamlining production processes and leveraging economies of scale, while established players focus on automation and process efficiency to remain competitive.

Vertical integration is a rising trend, with players like Ibiden and Samsung Electro-Mechanics controlling the entire supply chain, from raw materials to finished products. This offers greater control over quality and cost, providing a significant advantage.

Strategic partnerships and acquisitions are also playing a crucial role. Players are collaborating with universities and research institutions to accelerate innovation, while also acquiring smaller companies with specialized technologies or regional strengths to expand their reach.

Factors for Market Share Analysis:

Analyzing market share in the HDI PCB market requires a nuanced approach. Revenue and volume, though important, don't tell the whole story. Factors like product mix, technological capabilities, regional presence, and customer base need to be considered as well.

Companies catering to high-end applications like medical and aerospace, despite lower volumes, can command higher premiums and contribute significantly to market share. Similarly, regional dominance, particularly in emerging markets like India and Brazil, can be a key indicator of future growth potential.

New and Emerging Companies:

The HDI PCB market is not a closed club. Start-ups and niche players are constantly innovating and carving out their spaces. Companies like X-Fab and Europlacer are pushing the boundaries of miniaturization with advanced micro-via technologies. Others, like ViGTOR PCB, are focusing on eco-friendly materials and sustainable manufacturing practices, catering to the growing demand for green electronics.

These new entrants bring fresh perspectives and disruptive technologies, keeping the established players on their toes and ensuring continued dynamism in the market.

Latest Company Updates:

On Nov. 01, 2023, TTM Technologies (TTMI), a leading provider of PCB products, announced an investment of US$130 million into its new DeWitt facility to boost the U.S. microelectronics supply chain. TTMI aims to strengthen the national microelectronic supply chain by producing ultra-high-density interconnect PCBs for U.S military applications. The new plant adjacent to TTM's current facility will likely bring disruptive capability for ultra-HDI PCBs, offering shorter lead times, faster deliveries, and increased domestic capacity.

On Dec. 31, 2021, SIMMTECH (South Korea), a leading global manufacturer of PCB and packaging substrates for semiconductors, announced that it is setting up its first large-scale factory in Southeast Asia in Penang. The facility's construction is on track and scheduled for completion in the first quarter of 2022.

SIMMTECH's Malaysian subsidiary, Sustio Sdn Bhd, has invested RM508 BN in the project that aims to benefit local businesses with opportunities to be integrated into the global value chain. The factory will manufacture the region's first packaging substrates for high-density interconnect PCB for memory module/solid-state drive devices & operations, and dynamic random-access memory/NAND memory chips are expected to commence in 2Q22.

On Apr. 12, 2022, Bioptro, a leading developer of flip-chip ball grid array (FC-BGA) equipment and inspection equipment for HDI boards and FPCB announced that it is working on strengthening its new business by launching new inspection equipment for FC-BGA boards by 2022. Due to the trickle-down effect in the FC-BGA inspection equipment market, Bioptro has decided to increase its market share by localizing it.