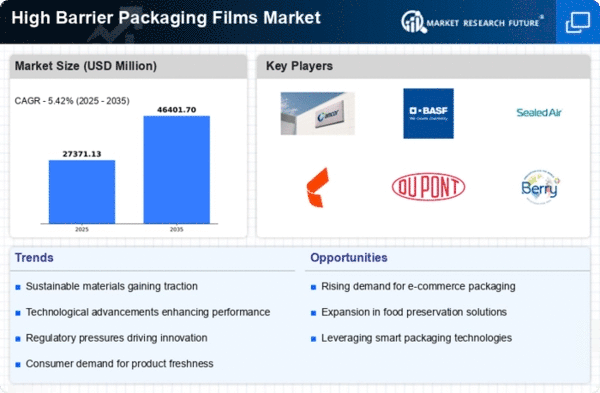

North America : Market Leader in Innovation

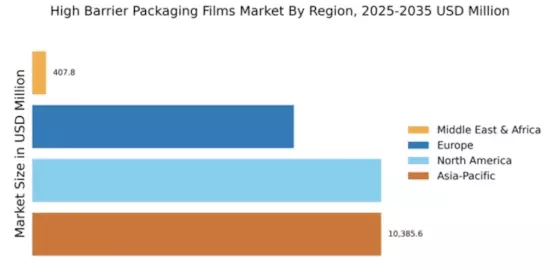

North America is witnessing robust growth in the High Barrier Packaging Films Market, driven by increasing demand for sustainable packaging solutions and stringent regulations on food safety. The market size reached $10,385.56 million in 2025, reflecting a significant share in the global landscape. Regulatory catalysts, such as the FDA's focus on food safety, are propelling innovations in packaging technologies, enhancing product shelf life and safety. The competitive landscape is dominated by key players like Amcor, Sealed Air, and DuPont, who are investing heavily in R&D to develop advanced materials. The U.S. leads the market, supported by a strong manufacturing base and a growing trend towards eco-friendly packaging. This region's focus on innovation and sustainability positions it as a leader in the high barrier packaging sector.

Europe : Sustainable Packaging Initiatives

Europe is emerging as a significant player in the High Barrier Packaging Films Market, with a market size of €7,785 million in 2025. The region is characterized by a strong emphasis on sustainability and regulatory frameworks aimed at reducing plastic waste. Initiatives like the European Green Deal are driving demand for eco-friendly packaging solutions, which are expected to dominate the market in the coming years. Leading countries such as Germany, France, and the UK are at the forefront of this transition, with companies like BASF and Mondi Group leading the charge in developing innovative materials. The competitive landscape is marked by collaborations between manufacturers and regulatory bodies to enhance product standards and sustainability practices, ensuring a robust market presence in Europe.

Asia-Pacific : Emerging Market Powerhouse

Asia-Pacific is the largest market for High Barrier Packaging Films, with a market size of $10,385.56 million in 2025. The region's growth is fueled by rapid industrialization, increasing consumer demand for packaged goods, and a shift towards high-quality packaging solutions. Countries like China and India are leading this growth, supported by favorable government policies and investments in manufacturing capabilities. The competitive landscape is vibrant, with key players such as Toppan Printing and Clondalkin Group expanding their operations in the region. The presence of a large consumer base and rising disposable incomes are driving demand for innovative packaging solutions, making Asia-Pacific a focal point for market expansion and investment in high barrier films.

Middle East and Africa : Niche Market Development

The Middle East and Africa (MEA) region is witnessing gradual growth in the High Barrier Packaging Films Market, with a market size of $407.77 million in 2025. The region's growth is primarily driven by increasing urbanization and a rising demand for packaged food products. Regulatory frameworks are evolving to support food safety and quality, which is expected to enhance market dynamics in the coming years. Countries like South Africa and the UAE are emerging as key players in this market, with local manufacturers focusing on developing high-quality packaging solutions. The competitive landscape is characterized by a mix of local and international players, creating opportunities for innovation and market penetration in this niche segment.