Top Industry Leaders in the High Barrier Packaging Films Market

The high barrier packaging films market, guarding the freshness and quality of our food and beverages. This market thrives on the need for longer shelf life, improved product protection, and innovative packaging solutions. But behind this promising growth lies a fiercely competitive landscape where established players battle it out with nimble innovators.

Strategies Shaping the Competitive Terrain:

-

Market Leaders: Companies like Amcor, Bemis Company, Dow Chemical, and ExxonMobil leverage their extensive production capacities, diverse product portfolios, and global reach to maintain dominance. Their strategies focus on continuous R&D for advanced barrier technologies, strategic acquisitions, and vertical integration to control costs. -

Regional Powerhouses: Regional players like UFlex in India and Toyobo in Japan hold strong positions in their respective markets. They compete on price, cater to regional preferences, and build strong local supplier networks. -

Sustainability Champions: Emerging players like Bio-On and NatureWorks LLC are carving niches with bio-based and biodegradable barrier films. They capitalize on environmental concerns and cater to customers seeking eco-friendly solutions, often at a premium.

Factors Influencing Market Share:

-

Barrier Performance and Innovation: Offering a diverse range of films with superior gas and moisture barrier properties, tailored to specific applications like meat, dairy, or pharmaceuticals, attracts a wider customer base and increases market share. Continuous innovation in materials and technologies is crucial. -

Production Efficiency and Cost Management: Optimizing manufacturing processes, sourcing raw materials cost-effectively, and offering competitive pricing are essential for gaining market share, particularly in price-sensitive segments. -

Sustainability and Regulatory Compliance: Adhering to environmental regulations and developing eco-friendly solutions like bio-based or recyclable films addresses environmental concerns and opens doors to new markets. -

Geographical Presence and Distribution Network: A strong global presence with efficient logistics and distribution networks ensures timely delivery and market reach, particularly in geographically diverse markets. -

Customer Service and Technical Support: Providing excellent technical support and building strong customer relationships fosters trust and repeat business, leading to market share consolidation.

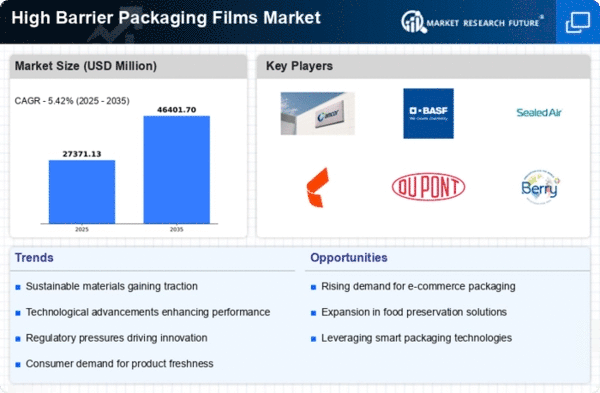

Key Players:

- Amcor plc

- Sealed air

- Huhtamaki

- Klockner pentaplast

- Mondi

- Constantia flexibles

- Berry global inc

- Coveris

- Sonoco product company

- Wipak

- Uflex limited

- Printpack

- Jindal poly films

- Cosmo films ltd.

Recent Developments :

December 2021: Amcor Plc introduced the first high-barrier, high-speed, recycle-ready liquid pouch packaging solution. It engineered a high barrier flexible film with superior heat resistance and is a more sustainable alternative to standard metalized or foil-based structures.

February 2022: Sealed Air announced the acquisition of Foxpak Flexibles Ltd. This initiative enabled the company to invest in disruptive technologies and business models to accelerate growth.

August 2023: DuPont announced the launch of its new line of Tyvek® bio-based high barrier films. The films are made from renewable resources and are designed to provide the same barrier properties as traditional Tyvek® films.

In April 2022, Toppan expanded its GL Barrier barrier range to include a mono-material PE barrier that is designed specifically for the packaging of liquid products using a material that is tough, sterile, and easy to recycle. In order to satisfy growing demand" in the European and North American markets, the firm argued that vapor deposition had presented difficulties previously with PE packaging and that its new barrier outperforms existing designs of this type.

In February 2022, Mondi partnered with Henkel to develop refill pouches that can be recycled as part of their commitment to sustainable packing solutions.