High Barrier Packaging Films Size

High Barrier Packaging Films Market Growth Projections and Opportunities

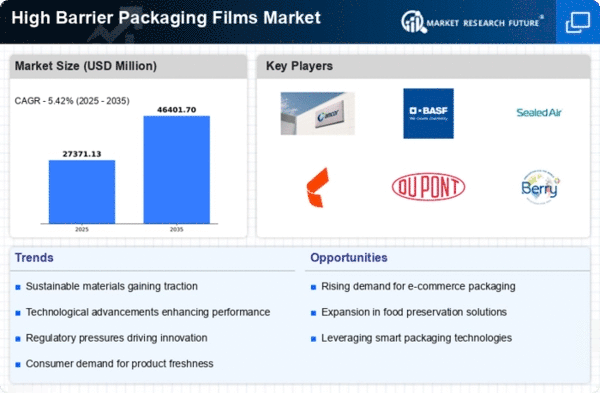

High performance packaging films industry possesses many features influencing its components, dynamic and growth rate. Besides the exact factor, there is the growth in the demand for products with an elongated shelf life and higher protective barriers for perishable goods. With the rise of consumer awareness cuisine safety and quality, there is a great demand for affordable packaging methods that can maintain freshness and the overall quality of produce. The upgraded packaging products like the high barrier packaging films with their capability to provide a protective barrier against oxygen, moisture, and other external elements address this need and are credited for being in higher demand now more than ever.

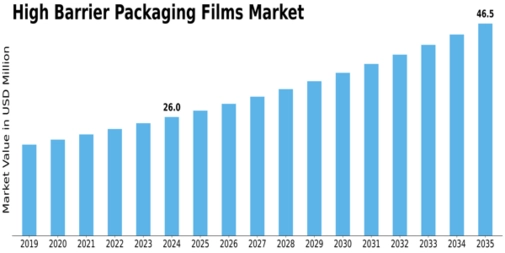

A huge size of the market for High Barrier Packaging Films reached the value of USD 22.88 billion last year. High barrier films for packaging market is anticipated to expand from USD 24.07 billion in 2022 to reach USD 36.11 billion in 2030, reflecting a compound annual growth rate (CAGR) of 5.2%.

Moreover, the growth of e-commerce too is an important one as it is demand OS increase for packaging films with barrier properties. The ecommerce business has been introduced to the long distance delivery of products and this in turn exposed them to some specific environmental problems. Barrier films with high elegant barrier design are the integral part of products protection from getting spoiled during the transportation of goods, as soon as they will be delivered to the consumers they will remain in the perfect condition.

On the other hand, heavier attention is being paid to environmental considerations in the packaging, therefore shaping the High Barrier Packaging Films market. As people become more knowledgeable about the damage done by wasteful packaging materials, they increasingly expect companies to adopt easy-on-the-environment and economical packaging solutions when supplying their products. It difficult time nowadays for manufactures to be competitive in the production of barrier packaging films. Hence, to achieve their target bio-based (defined as a source of raw material of agricultural and forest origin) and recyclable materials is essential as many manufacturers are re-orienting their products to align with the global effort towards sustainability

Similarly, regulatory landscape is one of the key factors that determines the high barrier films market. Governments enforcing regulations together with the participation of the regulatory bodies at preserving the safety and high quality of packaged goods. The restriction of the regulations is the responsibility of manufacturers and the regulations have become the motivation factor for manufactures to adopt high barrier packaging systems which meet or even exceed the standards level.

Low and high barrier films package technologies represent the future, through digital printing, smart packaging, and more advance films. As ongoing R&D endeavors are focused on the improvement of the films’ performance perspectives, such as the increased restriction of barriers, the elevated resistance to heat, and the positive compatibility with different packaging formats, there is a growing realization that more has to be done to meet the ever growing demand. Research and development of superior materials along with fresh technology is facilitating the production of high barrier films with functions relevant to the development of different sectors.

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Leave a Comment