Growth of the Snack Food Industry

The high barrier-packaging-films market is benefiting from the robust growth of the snack food industry. As snacking becomes a more prevalent eating habit among consumers, the demand for packaging that preserves freshness and flavor is escalating. In 2025, the snack food segment is projected to account for approximately 25% of the overall market, highlighting its significance. High barrier films are particularly suited for snack foods, as they provide essential protection against moisture and oxygen, which can compromise product quality. This trend is likely to continue, as manufacturers seek to leverage high barrier solutions to enhance the shelf life and appeal of their snack offerings, thereby driving market expansion.

Innovations in Packaging Technology

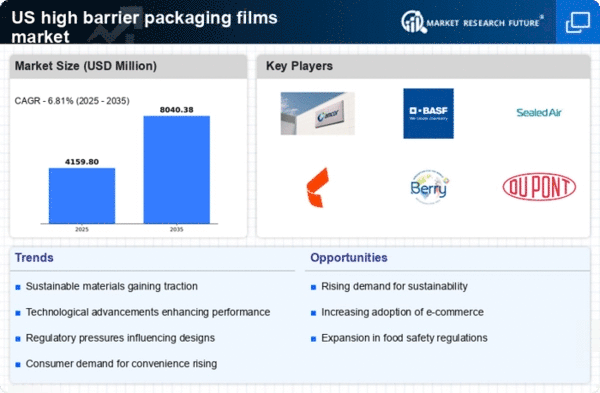

Innovations in packaging technology are playing a pivotal role in shaping the high barrier-packaging-films market. The introduction of advanced materials and manufacturing processes has led to the development of films that offer superior barrier properties, durability, and sustainability. For example, the integration of nanotechnology in film production has resulted in products that exhibit enhanced performance characteristics, such as improved resistance to punctures and tears. This technological evolution is expected to drive market growth, as companies seek to differentiate their products in a competitive landscape. In 2025, the market is projected to grow at a CAGR of 5.5%, largely attributed to these technological advancements that enhance the functionality and appeal of high barrier films.

Rising Demand for Food Preservation

The high barrier-packaging-films market is experiencing a notable increase in demand driven by the need for enhanced food preservation. As consumers become more health-conscious, the requirement for packaging that extends shelf life and maintains product integrity is paramount. In 2025, the food sector accounts for approximately 60% of the total market share, indicating a strong reliance on high barrier films to prevent spoilage and contamination. This trend is further supported by the growing preference for convenience foods, which often require robust packaging solutions. The ability of high barrier films to provide oxygen and moisture barriers is crucial in preserving the freshness of perishable goods, thereby driving their adoption in the food industry.

Regulatory Compliance and Safety Standards

The high barrier-packaging-films market is significantly influenced by stringent regulatory compliance and safety standards imposed by governmental bodies. In the US, regulations regarding food safety and packaging materials are becoming increasingly rigorous, necessitating the use of high-performance films that meet these standards. For instance, the FDA has established guidelines that require packaging materials to be safe for food contact, which has led to a surge in demand for high barrier films that comply with these regulations. This compliance not only ensures consumer safety but also enhances brand reputation, as companies strive to meet the expectations of both regulators and consumers. As a result, the market is likely to see continued growth as manufacturers invest in high barrier solutions that align with these evolving standards.

Consumer Preference for Sustainable Packaging

The high barrier-packaging-films market is increasingly influenced by consumer preference for sustainable packaging solutions. As environmental awareness rises, consumers are actively seeking products that minimize ecological impact. This shift in consumer behavior is prompting manufacturers to explore biodegradable and recyclable materials for high barrier films. In 2025, it is estimated that around 30% of consumers prioritize sustainability in their purchasing decisions, which is compelling companies to adapt their packaging strategies accordingly. The ability of high barrier films to combine sustainability with performance is becoming a key differentiator in the market, potentially leading to increased sales and brand loyalty as consumers gravitate towards environmentally friendly options.