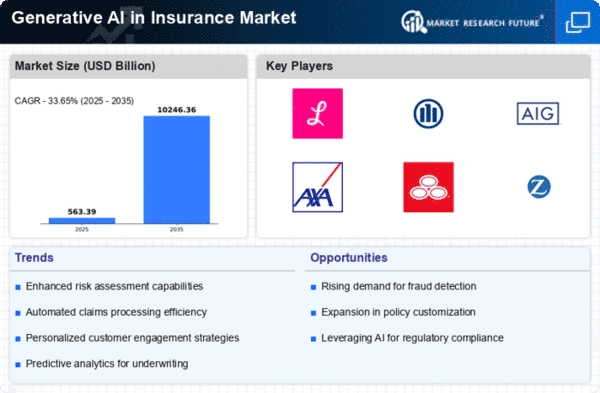

Market Growth Projections

The Global Generative AI In Insurance Market Industry is projected to experience substantial growth over the coming years. With a market value of 2.24 USD Billion in 2024, the industry is expected to expand significantly, reaching an estimated 28.6 USD Billion by 2035. This growth trajectory indicates a robust CAGR of 26.07% from 2025 to 2035, reflecting the increasing adoption of generative AI technologies across various insurance sectors. As insurers continue to explore innovative solutions to enhance efficiency and customer satisfaction, the market is poised for a transformative evolution.

Rising Demand for Automation

The Global Generative AI In Insurance Market Industry experiences a notable surge in demand for automation across various processes. Insurers are increasingly adopting generative AI technologies to streamline operations, enhance customer service, and reduce costs. For instance, AI-driven chatbots and virtual assistants are being utilized to handle customer inquiries, thereby improving response times and customer satisfaction. This trend is expected to contribute to the market's growth, with projections indicating a market value of 2.24 USD Billion in 2024, reflecting the industry's shift towards more efficient and automated solutions.

Integration of Advanced Technologies

The Global Generative AI In Insurance Market Industry is increasingly integrating advanced technologies such as machine learning and big data analytics. This integration enhances the capabilities of generative AI, allowing insurers to process and analyze large volumes of data more efficiently. By leveraging these technologies, insurers can improve decision-making processes, optimize claims management, and enhance customer experiences. The ongoing technological advancements are likely to drive the market's expansion, as insurers seek to remain competitive in a rapidly evolving landscape.

Enhanced Risk Assessment Capabilities

The Global Generative AI In Insurance Market Industry is witnessing advancements in risk assessment capabilities due to the integration of generative AI. Insurers are leveraging AI algorithms to analyze vast datasets, enabling more accurate risk predictions and personalized policy offerings. This capability not only enhances underwriting processes but also allows for dynamic pricing models that adapt to changing risk profiles. As a result, the market is poised for substantial growth, with expectations of reaching 28.6 USD Billion by 2035, driven by the increasing need for precise risk management solutions.

Personalization of Insurance Products

The Global Generative AI In Insurance Market Industry is characterized by a shift towards the personalization of insurance products. Insurers are utilizing generative AI to analyze customer data and preferences, enabling the creation of tailored insurance solutions that meet individual needs. This trend is particularly evident in sectors such as health and auto insurance, where personalized offerings can lead to improved customer engagement and retention. As the demand for personalized products continues to rise, the market is expected to grow significantly, with a projected CAGR of 26.07% from 2025 to 2035.

Regulatory Compliance and Fraud Detection

In the Global Generative AI In Insurance Market Industry, regulatory compliance and fraud detection are becoming increasingly critical. Generative AI tools are being deployed to monitor transactions and identify anomalies that may indicate fraudulent activities. This proactive approach not only helps insurers comply with regulatory standards but also mitigates financial losses associated with fraud. The growing emphasis on compliance and fraud prevention is likely to propel the market forward, as insurers seek innovative solutions to safeguard their operations and maintain customer trust.