Increased Demand for Automation

The Generative AI in Fintech Market experiences a notable surge in demand for automation solutions. Financial institutions are increasingly adopting AI-driven technologies to streamline operations, reduce costs, and enhance efficiency. According to recent data, the automation of routine tasks can lead to a reduction in operational costs by up to 30%. This trend is particularly evident in areas such as customer service, where chatbots and virtual assistants powered by generative AI are deployed to handle inquiries, thereby freeing human agents for more complex tasks. As the industry evolves, the integration of generative AI is likely to become a cornerstone of operational strategy, enabling firms to remain competitive in a rapidly changing landscape.

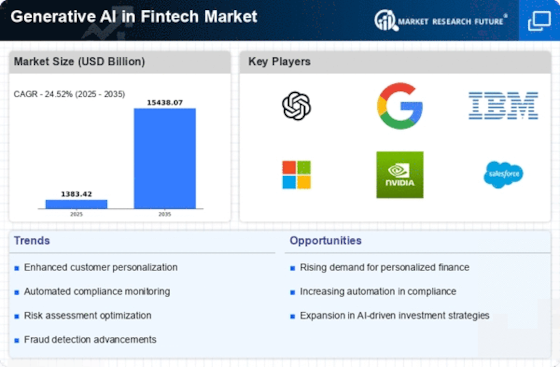

Personalized Financial Services

The Generative AI in Fintech Market is witnessing a transformation in the delivery of personalized financial services. With the ability to analyze customer data and preferences, generative AI enables financial institutions to tailor products and services to individual needs. This level of personalization can lead to increased customer satisfaction and loyalty, as clients receive recommendations that align closely with their financial goals. Recent studies indicate that personalized services can enhance customer retention rates by up to 25%. As competition intensifies, the ability to offer customized solutions will be a key differentiator for firms in the fintech landscape.

Innovation in Financial Products

The Generative AI in Fintech Market is characterized by a wave of innovation in financial products. Generative AI facilitates the development of new offerings that cater to evolving consumer demands. For example, AI-driven investment platforms can create personalized portfolios based on individual risk profiles and investment goals. This innovation not only enhances user experience but also democratizes access to sophisticated financial products. As the market continues to evolve, the introduction of AI-generated financial instruments is likely to reshape traditional investment paradigms, making it essential for firms to adapt to these changes to remain relevant.

Enhanced Data Analytics Capabilities

The Generative AI in Fintech Market is significantly influenced by advancements in data analytics capabilities. Financial institutions are leveraging generative AI to analyze vast amounts of data, uncovering insights that were previously unattainable. This capability allows for improved decision-making processes, risk assessment, and customer targeting. For instance, predictive analytics powered by generative AI can enhance credit scoring models, potentially increasing approval rates by 20% while minimizing default risks. As data continues to proliferate, the ability to harness this information effectively will be crucial for firms aiming to maintain a competitive edge in the fintech sector.

Regulatory Compliance and Risk Mitigation

The Generative AI in Fintech Market is increasingly shaped by the need for regulatory compliance and risk mitigation. Financial institutions face mounting pressure to adhere to stringent regulations, and generative AI offers innovative solutions to navigate this complex landscape. By automating compliance processes, firms can reduce the risk of human error and ensure adherence to evolving regulations. Moreover, generative AI can enhance risk assessment models, allowing institutions to identify potential threats more effectively. As regulatory frameworks continue to evolve, the integration of generative AI will likely become essential for firms seeking to mitigate risks and ensure compliance.