Growing Focus on Enhanced Customer Experience

In the GCC, businesses are increasingly prioritizing enhanced customer experience, which is significantly impacting the augmented analytics market. Organizations are leveraging analytics tools to gain deeper insights into customer behavior and preferences, enabling them to tailor their offerings accordingly. This focus on customer-centric strategies is expected to drive the market, as companies seek to utilize augmented analytics to improve engagement and satisfaction. It is estimated that organizations investing in customer experience analytics could see a return on investment of up to 300%. As a result, the demand for augmented analytics solutions that facilitate customer insights is likely to rise, further propelling market growth.

Rising Demand for Data-Driven Decision Making

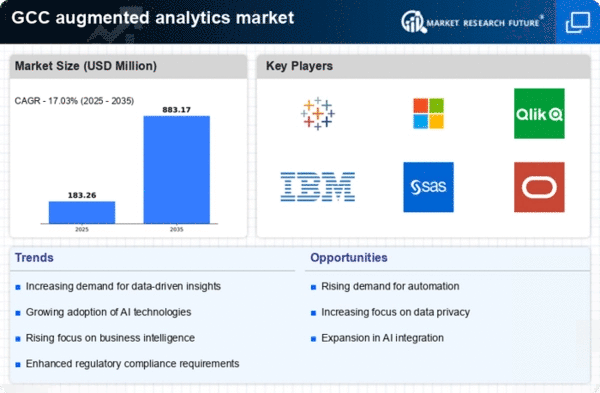

The augmented analytics market is experiencing a notable surge in demand as organizations in the GCC increasingly recognize the value of data-driven decision making. This trend is largely fueled by the need for businesses to enhance operational efficiency and gain competitive advantages. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. Companies are investing in advanced analytics tools to derive actionable insights from vast datasets, thereby improving their strategic planning and execution. This shift towards data-centric approaches is likely to drive the adoption of augmented analytics solutions, as organizations seek to leverage data for informed decision making and enhanced business outcomes.

Regulatory Compliance and Data Governance Needs

The augmented analytics market is influenced by the increasing emphasis on regulatory compliance and data governance in the GCC.. Organizations are required to adhere to stringent data protection regulations, which necessitate the implementation of robust analytics solutions that ensure data integrity and security. The market is witnessing a shift towards tools that not only provide insights but also facilitate compliance with legal standards. It is projected that the demand for analytics solutions that incorporate governance features will grow by 40% in the coming years. This trend indicates a significant opportunity for augmented analytics providers to develop solutions that address these compliance challenges while delivering valuable insights.

Advancements in Machine Learning and AI Capabilities

Advancements in machine learning and AI capabilities are playing a crucial role in shaping the augmented analytics market in the GCC. The integration of these technologies into analytics tools enhances their ability to process and analyze large volumes of data efficiently. Organizations are increasingly adopting augmented analytics solutions that leverage AI to automate data preparation and generate insights with minimal human intervention. This trend is expected to drive market growth, as businesses seek to harness the power of AI to improve their analytics processes. It is anticipated that the market for AI-driven analytics tools will expand by 30% over the next few years, reflecting the growing reliance on intelligent analytics solutions.

Integration of Augmented Analytics with Cloud Solutions

The integration of augmented analytics with cloud solutions is transforming the landscape in the GCC.. As organizations migrate to cloud-based platforms, the demand for analytics tools that can seamlessly operate in these environments is increasing. This integration allows for enhanced scalability, flexibility, and accessibility of data analytics capabilities. Reports indicate that cloud-based analytics solutions are expected to account for over 60% of the market share by 2026. The ability to access real-time data and insights from anywhere is driving organizations to adopt augmented analytics tools that are compatible with cloud infrastructures, thereby fostering growth in the market.