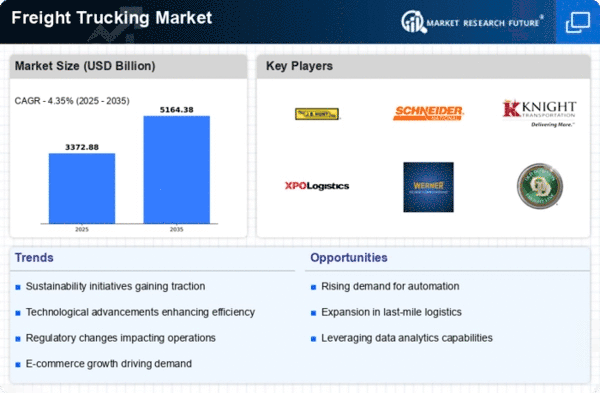

North America : Market Leader in Freight Trucking

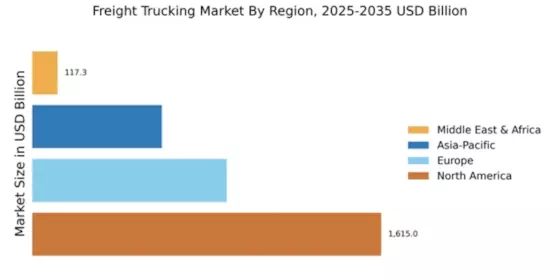

North America continues to lead the Freight Trucking Market, holding a significant market share of 1615.0 million. Key growth drivers include robust e-commerce demand, infrastructure investments, and regulatory support for sustainable practices. The region's extensive road networks and logistics capabilities further enhance its market position, making it a hub for freight transportation. Regulatory catalysts, such as emissions standards, are also shaping the industry's future.

The competitive landscape is characterized by major players like J.B. Hunt Transport Services, Schneider National, and XPO Logistics, which dominate the market. The U.S. remains the leading country, contributing significantly to the regional market size. The presence of these key players ensures a dynamic environment, fostering innovation and efficiency in freight trucking operations. As the market evolves, companies are increasingly focusing on technology integration and sustainability initiatives to maintain their competitive edge.

Europe : Emerging Freight Trucking Hub

Europe's Freight Trucking Market is poised for growth, with a market size of 900.0 million. Key drivers include increasing cross-border trade, advancements in logistics technology, and a shift towards greener transportation solutions. Regulatory frameworks, such as the European Green Deal, are pushing for more sustainable practices in the trucking industry, which is expected to further stimulate market growth. The demand for efficient logistics solutions is also on the rise, driven by e-commerce and consumer expectations.

Leading countries in this region include Germany, France, and the UK, which are home to several prominent players in the market. Companies like DSV Panalpina and DB Schenker are key competitors, enhancing the competitive landscape. The presence of these major players, along with a focus on innovation and sustainability, positions Europe as a significant player in The Freight Trucking. The region's commitment to reducing emissions will likely shape future market dynamics.

Asia-Pacific : Rapidly Growing Freight Market

The Asia-Pacific region is experiencing rapid growth in the Freight Trucking Market, with a market size of 600.0 million. Key growth drivers include urbanization, increasing consumer demand, and the expansion of logistics networks. Governments are investing in infrastructure improvements and regulatory reforms to enhance efficiency in freight transportation. The rise of e-commerce is also significantly contributing to the demand for freight trucking services across the region.

Countries like China, India, and Japan are leading the market, with a competitive landscape featuring both local and international players. Companies such as Nippon Express and CJ Logistics are prominent in the region, driving innovation and service improvements. The presence of these key players, along with a growing focus on technology and sustainability, is expected to shape the future of the freight trucking market in Asia-Pacific, making it a vital area for investment and growth.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region presents emerging opportunities in the Freight Trucking Market, with a market size of 117.28 million. Key growth drivers include increasing trade activities, infrastructure development, and a growing logistics sector. Governments are focusing on enhancing road networks and regulatory frameworks to support the freight industry. The demand for efficient transportation solutions is rising, driven by economic diversification and urbanization in several countries.

Leading countries in this region include South Africa, UAE, and Nigeria, where the competitive landscape is evolving. Local players are increasingly entering the market, while international companies are also establishing a presence. The growth of e-commerce and logistics services is fostering a dynamic environment, encouraging innovation and investment in the freight trucking sector. As the region continues to develop, it is expected to attract more players and investment opportunities.