Rising Demand for Liquid Transportation

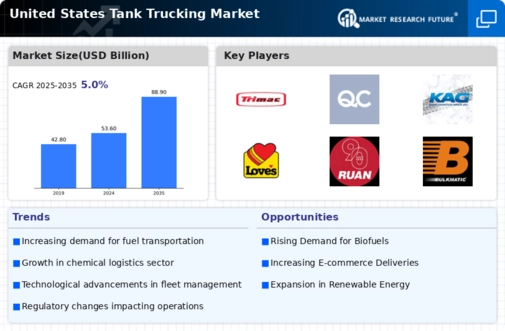

The Global United States Tank Trucking Market Industry experiences a notable increase in demand for liquid transportation services. This surge is primarily driven by the expanding chemical and petroleum sectors, which require efficient logistics solutions for transporting various liquids. In 2024, the market is valued at approximately 53.6 USD Billion, reflecting the industry's capacity to adapt to the growing needs of these sectors. Furthermore, as environmental regulations tighten, companies are increasingly relying on tank trucking to ensure compliance while maintaining operational efficiency. This trend suggests a robust future for the industry, potentially leading to a market valuation of 88.9 USD Billion by 2035.

Regulatory Compliance and Safety Standards

The Global United States Tank Trucking Market Industry is significantly influenced by stringent regulatory compliance and safety standards. Government regulations regarding the transportation of hazardous materials necessitate that trucking companies invest in specialized equipment and training for their drivers. This focus on safety not only protects the environment but also enhances the reputation of the industry. Companies that prioritize compliance are likely to gain a competitive edge, as clients increasingly seek reliable partners for transporting sensitive materials. As regulations continue to evolve, the industry must adapt, potentially driving further growth and innovation in the sector.

Market Diversification and Service Expansion

Market diversification and service expansion are critical drivers for the Global United States Tank Trucking Market Industry. Companies are increasingly broadening their service offerings to include specialized transportation solutions, such as temperature-controlled tankers and multi-modal logistics services. This diversification allows businesses to cater to a wider range of industries, including pharmaceuticals and food processing, which require specific handling and transportation conditions. As the market evolves, companies that successfully adapt to these changing demands are likely to thrive, contributing to the overall growth of the industry and enhancing its resilience against economic fluctuations.

Growth of E-commerce and Just-in-Time Delivery

The rise of e-commerce has a profound impact on the Global United States Tank Trucking Market Industry, as businesses increasingly rely on just-in-time delivery models. This shift necessitates efficient logistics solutions for transporting liquids, particularly in sectors such as food and beverage, pharmaceuticals, and chemicals. The demand for timely deliveries drives the need for tank trucking services, as companies seek to minimize inventory costs while ensuring product availability. As e-commerce continues to expand, the industry is poised for growth, with projections indicating a market value of 88.9 USD Billion by 2035, reflecting the increasing reliance on liquid transportation.

Technological Advancements in Fleet Management

Technological innovations play a pivotal role in enhancing the efficiency of the Global United States Tank Trucking Market Industry. The integration of advanced fleet management systems, including GPS tracking and telematics, allows companies to optimize routes, reduce fuel consumption, and improve overall service delivery. These technologies not only enhance operational efficiency but also contribute to safety and compliance with regulatory standards. As the industry embraces these advancements, it is likely to see a sustained growth trajectory, with a projected CAGR of 4.7% from 2025 to 2035. This growth underscores the importance of technology in meeting the evolving demands of liquid transportation.

Leave a Comment