Labor Shortages

Labor shortages represent a pressing challenge for the freight trucking market. The industry is currently facing a significant shortage of qualified drivers, with estimates suggesting a deficit of over 80,000 drivers in 2025. This shortage is attributed to various factors, including an aging workforce and the demanding nature of the job. As trucking companies struggle to attract and retain talent, they may experience increased operational costs and reduced service levels. Consequently, many firms are exploring innovative solutions, such as offering competitive wages, improved working conditions, and enhanced training programs to address this issue. The ability to effectively manage labor shortages will be critical for the sustainability and growth of the freight trucking market in the coming years.

Regulatory Changes

Regulatory changes are significantly influencing the freight trucking market. In 2025, new regulations aimed at improving safety and environmental standards are being implemented, which may require trucking companies to invest in updated technologies and practices. For instance, the introduction of stricter emissions standards could compel operators to transition to cleaner fuel options or invest in electric vehicles. Compliance with these regulations may incur additional costs, but it also presents opportunities for innovation within the freight trucking market. Companies that proactively adapt to regulatory changes can enhance their competitive edge and appeal to environmentally conscious consumers. Thus, navigating the evolving regulatory landscape is essential for the long-term viability of the freight trucking market.

Rising E-commerce Demand

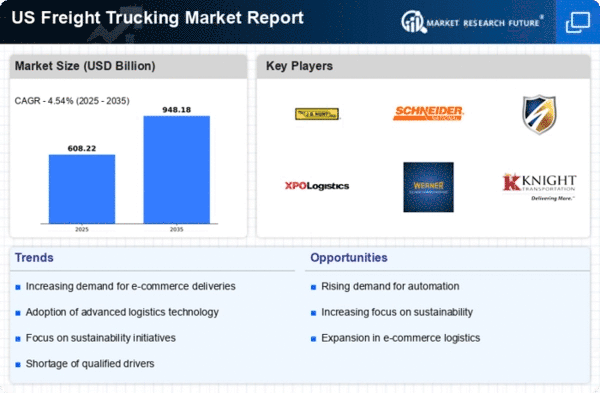

The freight trucking market is experiencing a notable surge in demand driven by the rapid growth of e-commerce. As online shopping continues to gain traction, logistics and transportation services are increasingly required to meet consumer expectations for fast delivery. In 2025, e-commerce sales in the US are projected to reach approximately $1 trillion, necessitating a robust freight trucking market to facilitate the movement of goods. This trend compels trucking companies to enhance their operational efficiency and expand their fleets to accommodate the rising volume of shipments. Furthermore, the shift towards direct-to-consumer delivery models places additional pressure on the freight trucking market to adapt quickly to changing logistics demands, thereby fostering innovation and investment in technology and infrastructure.

Infrastructure Investment

Investment in infrastructure plays a crucial role in shaping the freight trucking market. The US government has recognized the need for modernizing transportation networks, with significant funding allocated for road repairs and upgrades. In 2025, it is estimated that the federal and state governments will invest over $100 billion in infrastructure projects, which directly impacts the efficiency of freight movement. Improved road conditions and expanded highway systems reduce transit times and operational costs for trucking companies. Additionally, enhanced infrastructure supports the integration of advanced technologies, such as smart traffic management systems, which can optimize routing and reduce congestion. As a result, the freight trucking market stands to benefit from these investments, leading to increased reliability and competitiveness in the logistics sector.

Technological Integration

the integration of advanced technologies is revolutionizing the freight trucking market.. Innovations such as telematics, route optimization software, and autonomous vehicles are reshaping how goods are transported. In 2025, it is anticipated that the adoption of these technologies will increase operational efficiency by up to 30%, allowing trucking companies to reduce costs and improve service delivery. Furthermore, the use of data analytics enables firms to make informed decisions regarding fleet management and logistics planning. As technology continues to evolve, the freight trucking market is likely to see increased investment in digital solutions that enhance transparency and tracking capabilities. This technological shift not only streamlines operations but also positions the industry for future growth and competitiveness.