On-the-Go Lifestyle

The fast-paced lifestyle of modern consumers significantly influences the Food Bar Market. As individuals seek convenient meal options that fit into their busy schedules, food bars have emerged as a preferred choice. The increasing prevalence of snacking, particularly among younger demographics, has led to a surge in demand for portable and easy-to-consume food products. Market analysis suggests that the convenience factor is a primary driver, with a substantial percentage of consumers indicating that they prefer snacks that can be consumed without preparation. This trend is likely to continue, as more individuals prioritize convenience in their dietary choices. Consequently, brands are focusing on packaging innovations and product formulations that cater to this need, thereby solidifying their position in the competitive landscape of the Food Bar Market.

Health Conscious Consumer Trends

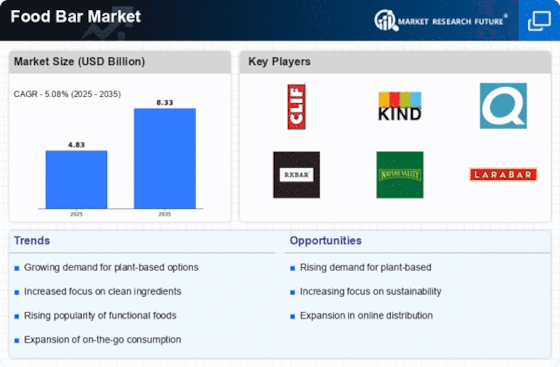

The Food Bar Market is experiencing a notable shift towards health-conscious consumer behavior. As individuals increasingly prioritize nutrition, the demand for food bars that offer functional benefits, such as protein, fiber, and vitamins, is on the rise. According to recent data, the market for protein bars alone is projected to reach approximately 1.5 billion USD by 2026, indicating a robust growth trajectory. This trend is further fueled by the growing awareness of dietary choices and their impact on overall health. Consumers are gravitating towards food bars that are low in sugar and free from artificial ingredients, reflecting a broader movement towards clean eating. Consequently, manufacturers are innovating to create products that align with these preferences, thereby enhancing their market presence within the Food Bar Market.

Technological Advancements in Production

Technological advancements are playing a pivotal role in shaping the Food Bar Market. Innovations in food processing and manufacturing techniques are enabling brands to enhance product quality and efficiency. For instance, advancements in ingredient sourcing and formulation allow for the creation of food bars that are not only nutritious but also appealing in taste and texture. Additionally, technology facilitates better tracking of supply chains, ensuring transparency and quality control. Industry expert's suggest that companies leveraging technology to improve their production processes are likely to gain a competitive edge. Furthermore, the integration of e-commerce platforms is transforming how consumers access food bars, making it easier for them to explore a wider range of products. As technology continues to advance, it is anticipated that the Food Bar Market will experience further growth and innovation.

Diverse Flavor Profiles and Customization

The Food Bar Market is witnessing a growing trend towards diverse flavor profiles and customization options. Consumers are increasingly seeking unique and exciting flavors that cater to their taste preferences, moving beyond traditional offerings. This demand for variety is prompting manufacturers to experiment with innovative ingredients and flavor combinations, thereby enhancing product appeal. Additionally, the rise of personalization in food products allows consumers to tailor their food bar choices to meet specific dietary needs or preferences. Market data indicates that brands offering customizable options are likely to capture a larger share of the market, as consumers appreciate the ability to select ingredients that align with their health goals. This trend not only fosters brand loyalty but also encourages repeat purchases, contributing to the overall growth of the Food Bar Market.

Sustainability and Eco-Friendly Practices

Sustainability is becoming an increasingly critical factor within the Food Bar Market. As consumers become more environmentally conscious, there is a growing demand for food bars that are produced using sustainable practices and eco-friendly packaging. Brands that prioritize ethical sourcing of ingredients and minimize their environmental footprint are likely to resonate with a significant segment of the market. Recent surveys indicate that a considerable percentage of consumers are willing to pay a premium for products that align with their sustainability values. This shift is prompting manufacturers to adopt greener practices, such as using recyclable materials and reducing waste in production processes. As sustainability continues to shape consumer preferences, it is expected that the Food Bar Market will evolve to meet these expectations, thereby fostering a more responsible approach to food production.