Market Analysis

In-depth Analysis of Food bar Market Industry Landscape

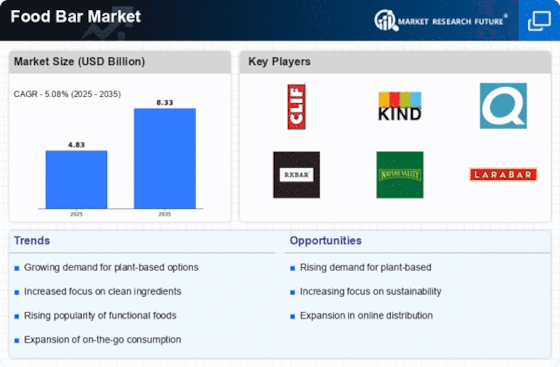

The food bar market is characterized by a dynamic interplay of factors influencing both the supply and demand sides of the industry. One of the primary drivers propelling the growth of the food bar market is the increasing demand for convenient and nutritious on-the-go snacks. Food bars, available in various formulations such as protein bars, granola bars, and energy bars, cater to consumers seeking quick and portable options that align with their busy lifestyles. The market has witnessed a surge in demand as health-conscious consumers look for snacks that offer a balance of taste and nutritional benefits. Changing dietary habits and a focus on wellness significantly impact the market dynamics of food bars. As consumers become more conscious of their health and nutritional intake, there is a growing demand for bars that not only taste good but also provide functional benefits. Protein bars, in particular, have gained popularity among fitness enthusiasts and those looking to increase their protein intake as part of a healthy diet. This trend has led to product innovation and the introduction of bars with specialized formulations targeting specific dietary needs. Geographical variations play a role in shaping the market dynamics of food bars. Different regions have diverse dietary preferences, and cultural influences impact the types of bars that gain popularity. For example, regions with a strong fitness culture may have a higher demand for protein bars, while markets with a focus on natural and organic products may gravitate towards bars with clean and simple ingredient lists. This diversity necessitates flexibility among manufacturers to tailor their offerings to regional tastes and preferences. The retail landscape and distribution channels significantly influence the market dynamics of food bars. Food bars are distributed through various channels, including supermarkets, convenience stores, gyms, and online platforms. The accessibility and visibility of food bar brands in these channels impact consumer awareness and purchasing decisions. The rise of e-commerce has further expanded the reach of food bars, allowing consumers to explore a wide variety of options and facilitating the growth of niche and specialty brands. Competition within the food bar market is shaped by factors such as taste, nutritional content, packaging, and brand visibility. Companies aim to differentiate their products by offering unique flavors, incorporating functional ingredients, and using attractive packaging designs. Marketing strategies highlighting the nutritional benefits, convenience, and taste appeal of food bars contribute to brand competitiveness in a market where consumer choices are influenced by both health considerations and sensory preferences. Government regulations and labeling standards significantly influence the market dynamics of food bars. Compliance with food safety regulations and accurate nutritional labeling are essential for building consumer trust. As health and wellness trends continue to shape consumer preferences, transparent and informative labeling becomes a crucial aspect for manufacturers to communicate the nutritional value of their products. Consumer trends towards sustainability also impact the market dynamics of food bars. There is a growing awareness among consumers about the environmental impact of packaging and ingredient sourcing. Companies adopting sustainable practices, such as using eco-friendly packaging materials and sourcing ethically produced ingredients, are better positioned to meet the evolving preferences of environmentally conscious consumers.

Leave a Comment