Growth in Renewable Energy Sector

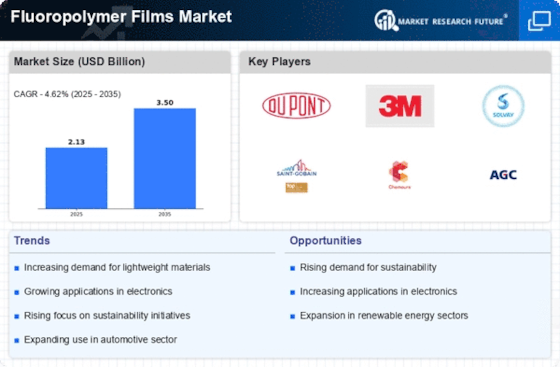

The Fluoropolymer Films Market is poised to benefit from the expansion of the renewable energy sector. As the world increasingly focuses on sustainable energy solutions, fluoropolymer films are becoming essential in applications such as solar panels and wind turbine components. These films offer excellent chemical resistance and thermal stability, making them ideal for protecting sensitive electronic components in renewable energy systems. The market for solar energy, in particular, has seen substantial growth, with forecasts indicating a potential increase in demand for fluoropolymer films by approximately 6% annually. This growth is driven by the need for efficient energy solutions and the durability that fluoropolymer films provide, thereby enhancing the overall performance and reliability of renewable energy technologies.

Advancements in Medical Technology

The Fluoropolymer Films Market is significantly influenced by advancements in medical technology. Fluoropolymer films are increasingly utilized in medical devices and equipment due to their biocompatibility and resistance to chemicals. These films are essential in applications such as drug delivery systems, surgical instruments, and protective barriers. The medical device market has been expanding rapidly, with estimates suggesting a growth rate of around 7% per year. This trend indicates a rising demand for high-performance materials that can meet stringent regulatory standards. As healthcare continues to evolve, the role of fluoropolymer films in enhancing the safety and efficacy of medical technologies is likely to become more pronounced, further driving market growth.

Emerging Applications in Electronics

The Fluoropolymer Films Market is experiencing growth due to emerging applications in the electronics sector. With the proliferation of electronic devices, there is an increasing need for materials that can provide insulation and protection against environmental factors. Fluoropolymer films are utilized in various electronic components, including circuit boards and connectors, due to their excellent dielectric properties and thermal stability. The electronics market is projected to grow at a rate of around 5% annually, which is likely to bolster the demand for fluoropolymer films. As technology continues to advance, the versatility and performance of fluoropolymer films will be crucial in meeting the evolving needs of the electronics industry.

Increased Focus on Chemical Resistance

The Fluoropolymer Films Market is witnessing a heightened focus on chemical resistance across various sectors. Industries such as chemicals, pharmaceuticals, and food processing require materials that can withstand aggressive substances without degrading. Fluoropolymer films are renowned for their exceptional chemical resistance, making them a preferred choice for protective linings and packaging solutions. The demand for these films is expected to rise as industries prioritize safety and compliance with regulatory standards. Market analysis suggests that the chemical processing sector alone could contribute to a growth rate of approximately 4% in the fluoropolymer films market. This trend highlights the critical role that chemical resistance plays in driving the adoption of fluoropolymer films in diverse applications.

Rising Demand in Automotive Applications

The Fluoropolymer Films Market is experiencing a notable surge in demand from the automotive sector. This is primarily due to the increasing need for lightweight and durable materials that can withstand extreme temperatures and harsh environments. Fluoropolymer films are utilized in various automotive components, including insulation and protective coatings, which enhance performance and longevity. As the automotive industry shifts towards electric vehicles, the demand for advanced materials is expected to grow. Reports indicate that the automotive sector accounts for a significant share of the fluoropolymer films market, with projections suggesting a compound annual growth rate of around 5% over the next few years. This trend underscores the importance of fluoropolymer films in meeting the evolving requirements of modern automotive design and manufacturing.