Rising Demand in Automotive Sector

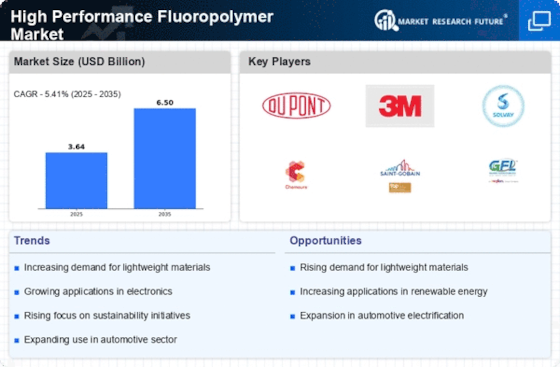

The automotive sector is experiencing a notable increase in demand for high performance fluoropolymers, primarily due to their exceptional chemical resistance and thermal stability. These materials are increasingly utilized in fuel systems, gaskets, and seals, which are critical for enhancing vehicle efficiency and longevity. The high performance fluoropolymer market is projected to witness a compound annual growth rate of approximately 6% over the next few years, driven by the automotive industry's shift towards lightweight materials and improved fuel efficiency standards. As manufacturers seek to comply with stringent regulations regarding emissions and safety, the adoption of high performance fluoropolymers is likely to expand, thereby bolstering market growth.

Increased Focus on Chemical Processing

The chemical processing industry is increasingly recognizing the advantages of high performance fluoropolymers, particularly in applications involving corrosive substances. These materials provide superior resistance to a wide range of chemicals, making them ideal for use in pipes, valves, and linings. The high performance fluoropolymer market is projected to benefit from this trend, with a potential market growth of around 5% annually as industries seek to enhance safety and efficiency in chemical handling. Furthermore, the need for durable and reliable materials in chemical processing is likely to drive innovation and development within the high performance fluoropolymer sector, fostering a competitive landscape.

Emerging Applications in Renewable Energy

The renewable energy sector is beginning to adopt high performance fluoropolymers for various applications, including solar panels and wind turbine components. These materials offer excellent durability and resistance to environmental factors, which are essential for the longevity of renewable energy systems. The high performance fluoropolymer market is projected to expand as the global push for sustainable energy solutions intensifies. With an expected market growth rate of around 5% in the coming years, the integration of high performance fluoropolymers in renewable energy applications may play a pivotal role in enhancing the efficiency and reliability of these technologies. As the world transitions towards greener energy sources, the demand for such advanced materials is likely to increase.

Growth in Aerospace and Defense Applications

The aerospace and defense sectors are increasingly utilizing high performance fluoropolymers due to their lightweight nature and exceptional thermal stability. These materials are critical in applications such as seals, gaskets, and insulation for wiring and components. The high performance fluoropolymer market is anticipated to see a growth trajectory of approximately 7% as the demand for advanced materials in aerospace applications rises. This growth is driven by the need for enhanced performance in extreme conditions, as well as the ongoing development of new aircraft and defense systems. As these sectors continue to evolve, the reliance on high performance fluoropolymers is likely to intensify.

Expansion in Electronics and Electrical Applications

The electronics and electrical sectors are rapidly adopting high performance fluoropolymers due to their excellent dielectric properties and resistance to high temperatures. These materials are essential in the production of insulators, connectors, and circuit boards, where reliability and performance are paramount. The high performance fluoropolymer market is expected to grow significantly, with estimates suggesting a market size increase of over 4 billion USD by 2027. This growth is attributed to the rising demand for miniaturized electronic devices and the need for materials that can withstand harsh operating conditions. As technology continues to advance, the role of high performance fluoropolymers in electronics is likely to become even more critical.