Market Analysis

In-depth Analysis of Fluoropolymer Films Market Industry Landscape

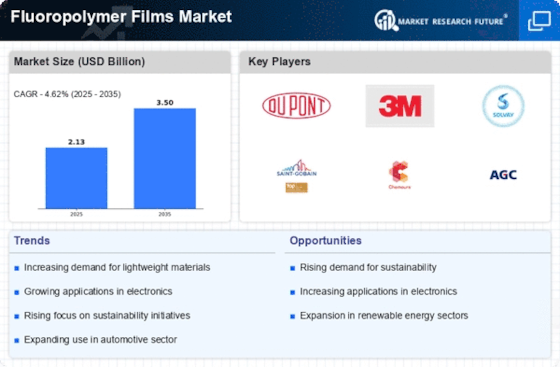

The market dynamics of the Fluoropolymer Films industry are shaped by a combination of various factors that influence supply, demand, and overall market trends. Fluoropolymer films are highly sought after due to their exceptional properties such as high chemical resistance, thermal stability, and non-stick characteristics. These films find extensive applications in industries like electronics, automotive, aerospace, and packaging. One key driver of the market is the increasing demand for high-performance materials in these sectors. The growing awareness of environmental concerns and the need for sustainable solutions have also led to the rising adoption of fluoropolymer films, which are known for their durability and longevity.

On the supply side, the market dynamics are influenced by the availability of raw materials, primarily fluoropolymers like polytetrafluoroethylene (PTFE), polyvinylidene fluoride (PVDF), and others. The production processes and technologies employed by manufacturers also play a crucial role in determining the supply chain efficiency and overall market competitiveness. Companies investing in research and development to enhance manufacturing processes and reduce production costs gain a competitive edge, affecting the overall market dynamics.

Global economic conditions and geopolitical factors also impact the fluoropolymer films market dynamics. Fluctuations in currency exchange rates, trade policies, and geopolitical tensions can affect the cost of raw materials, production, and transportation, ultimately influencing the market prices of fluoropolymer films. Additionally, the industry is responsive to regulatory changes related to environmental standards and product safety. Compliance with these regulations not only shapes the competitive landscape but also affects consumer preferences, driving the demand for eco-friendly and compliant fluoropolymer films.

Market dynamics are further influenced by technological advancements. Ongoing research and development efforts lead to the introduction of innovative fluoropolymer film products with enhanced properties. These advancements can disrupt the market by offering superior performance or cost-effectiveness, thereby influencing consumer choices and industry trends. As industries evolve, the demand for specific characteristics in fluoropolymer films may change, necessitating constant adaptation and innovation by market players.

Competitive forces within the fluoropolymer films market also contribute significantly to its dynamics. The presence of established manufacturers, emerging players, and the threat of new entrants shape the level of competition. Strategic collaborations, mergers, and acquisitions are common strategies adopted by companies to strengthen their market position and expand their product portfolios. Price competition, quality differentiation, and customer service become crucial elements in gaining a competitive advantage.

Moreover, the influence of end-user industries on the fluoropolymer films market cannot be understated. The growth of sectors like electronics and automotive directly impacts the demand for high-performance materials, driving the market forward. Similarly, evolving consumer preferences, environmental consciousness, and regulatory standards in packaging industries contribute to the changing landscape of the fluoropolymer films market.

The increasing growth of the potential end-users and the growing economic condition of the countries which are considered as the manufacturing hubs are expected to boost the overall growth of the fluoropolymer films industry. For instance, China is considered as the leading manufacturer of electronics, automotive and is also considered as the leading producer of fluoropolymer films. Moreover, China has been adopting fluoropolymer films for the production of solar panels and semiconductors as well. The favorable economic condition and the utilization of advanced technologies by the region are expected to boost the overall growth of the fluoropolymer films industry.

Leave a Comment