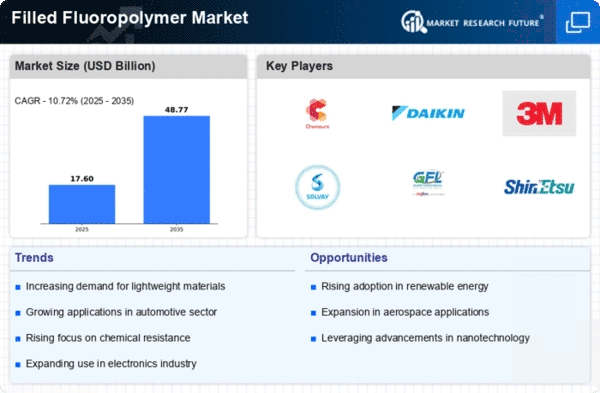

Market Growth Projections

The Global Filled Fluoropolymer Market Industry is projected to experience substantial growth over the coming years. With a market value anticipated to reach 3.43 USD Billion in 2024 and further expand to 6.69 USD Billion by 2035, the industry is poised for a robust trajectory. The compound annual growth rate of 6.26% from 2025 to 2035 underscores the increasing demand for filled fluoropolymers across various sectors. This growth is driven by factors such as advancements in manufacturing technologies, rising applications in electronics, and a heightened focus on sustainability. The market's expansion reflects the critical role filled fluoropolymers play in meeting the evolving needs of diverse industries.

Regulatory Support and Standards

The Global Filled Fluoropolymer Market Industry is benefiting from supportive regulatory frameworks and standards that promote the use of high-performance materials. Governments and industry bodies are establishing regulations that encourage the adoption of advanced materials in various applications, particularly in sectors such as aerospace, automotive, and chemical processing. These regulations often emphasize safety, performance, and environmental considerations, driving manufacturers to incorporate filled fluoropolymers into their products. As compliance with these standards becomes increasingly critical, the market is likely to see sustained growth, with a focus on materials that meet stringent regulatory requirements.

Increased Focus on Sustainability

Sustainability is becoming a pivotal driver in the Global Filled Fluoropolymer Market Industry. As industries strive to reduce their environmental impact, the demand for materials that offer longevity and reduce waste is rising. Filled fluoropolymers, known for their durability and resistance to degradation, align well with these sustainability goals. Companies are increasingly adopting these materials to enhance the lifespan of their products, thereby minimizing the need for frequent replacements. This shift towards sustainable practices is likely to bolster market growth, as organizations recognize the long-term benefits of investing in high-quality materials that contribute to environmental conservation.

Rising Applications in Electronics

The Global Filled Fluoropolymer Market Industry is witnessing a surge in applications within the electronics sector. The unique dielectric properties of filled fluoropolymers make them ideal for insulating materials in electronic components. As the demand for miniaturized and high-performance electronic devices increases, manufacturers are turning to filled fluoropolymers to meet these requirements. This trend is expected to drive market growth, with a projected compound annual growth rate of 6.26% from 2025 to 2035. The integration of filled fluoropolymers in electronic applications not only enhances performance but also contributes to the longevity and reliability of devices, further solidifying their market position.

Growing Demand in Chemical Processing

The Global Filled Fluoropolymer Market Industry is experiencing heightened demand in the chemical processing sector. This is largely due to the unique properties of filled fluoropolymers, such as their exceptional chemical resistance and thermal stability. Industries that handle aggressive chemicals are increasingly adopting these materials to enhance the durability and lifespan of their equipment. For instance, filled fluoropolymers are utilized in linings for pipes and tanks, which are crucial in preventing leaks and corrosion. As a result, the market is projected to reach 3.43 USD Billion in 2024, reflecting a robust growth trajectory driven by the need for reliable materials in challenging environments.

Advancements in Manufacturing Technologies

Technological advancements in the production of filled fluoropolymers are significantly influencing the Global Filled Fluoropolymer Market Industry. Innovations in manufacturing processes, such as improved compounding techniques and extrusion methods, have led to enhanced material properties and performance. These advancements allow for the production of filled fluoropolymers with tailored characteristics, catering to specific applications in various industries, including automotive and aerospace. As manufacturers adopt these new technologies, the market is likely to expand, with projections indicating a growth to 6.69 USD Billion by 2035. This growth is indicative of the increasing reliance on high-performance materials in demanding applications.