Market Trends

Key Emerging Trends in the Fluoropolymer Films Market

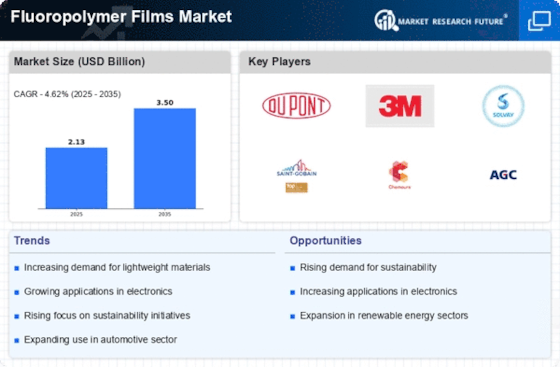

The Fluoropolymer Films Market has witnessed notable trends and shifts in recent times, reflecting the dynamic nature of this industry. Fluoropolymer films, known for their exceptional chemical resistance, high thermal stability, and unique electrical properties, have gained substantial traction across various applications. One prominent trend driving the market is the increasing demand for these films in the automotive sector. With a rising focus on lightweight materials to enhance fuel efficiency, fluoropolymer films find extensive use in automotive interiors and exteriors, contributing to a surge in market growth.

Additionally, the electronics and electrical industry has emerged as a key influencer in shaping the market trends of fluoropolymer films. As technology advances, there is a growing need for materials that can provide insulation, corrosion resistance, and high dielectric strength. Fluoropolymer films meet these requirements, making them integral components in the manufacturing of electronic components and cables. This trend is expected to persist and expand as the electronics industry continues to evolve, creating a robust market for these specialized films.

Moreover, the healthcare sector has emerged as an unexpected but significant consumer of fluoropolymer films. These films are increasingly being used in medical devices due to their biocompatibility and resistance to harsh sterilization processes. The trend is likely to continue, driven by the ongoing developments in medical technology and the growing demand for advanced, durable materials in healthcare applications.

Environmental considerations are also influencing the market trends of fluoropolymer films. With an increased emphasis on sustainability and eco-friendly solutions, manufacturers are exploring fluoropolymer films as alternatives to traditional materials in various industries. The recyclability and longevity of these films make them attractive options for businesses looking to reduce their environmental footprint.

Furthermore, the Asia-Pacific region has emerged as a focal point for market growth. The rapid industrialization, infrastructure development, and expanding automotive and electronics sectors in countries like China and India have created substantial opportunities for the fluoropolymer films market. The region's economic growth, coupled with increasing investments in research and development, positions it as a significant player in shaping the global market trends.

However, challenges such as raw material price fluctuations and the stringent regulatory landscape may pose hurdles to market expansion. The volatility in raw material prices, especially for key components of fluoropolymer films, can impact production costs and subsequently influence market trends. Additionally, stringent regulations related to environmental and health concerns may necessitate compliance measures, potentially impacting the overall market dynamics.

The involvement of crude oil in the production of fluoropolymer films and the fluctuation in the prices of crude oil across the globe is considered as the major challenge for the overall growth of the Fluoropolymer films industry.

The processing and the manufacturing of the fluoropolymer films are extremely complex and incur several stages of chemical fusions. The several stages and processes add up the manufacturing costs and thereby increase the overall manufacturing costs of the Fluoropolymer films. Such factors are considered as the major challenge for the overall growth of the Fluoropolymer films industry.

Leave a Comment