North America : Growing Demand for Fishmeal

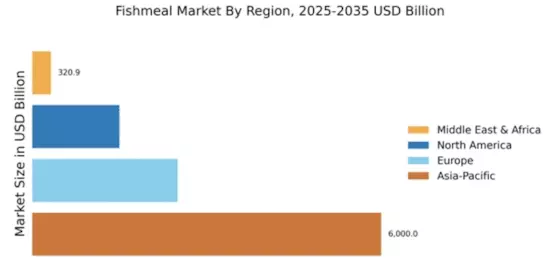

The North American fishmeal market is projected to reach $1,500.0 million by 2025, driven by increasing demand for sustainable aquaculture and livestock feed. Regulatory support for sustainable fishing practices and environmental conservation is enhancing market growth. The region's focus on high-quality fishmeal products is also a significant growth driver, as consumers become more health-conscious and environmentally aware. Leading countries in this region include the US and Canada, where major players like Cargill and Omega Protein dominate the market. The competitive landscape is characterized by a mix of established companies and emerging players, all striving to innovate and meet the growing demand for fishmeal. The presence of key players ensures a robust supply chain, contributing to the overall market stability and growth.

Europe : Innovation and Sustainability Focus

Europe's fishmeal market is expected to reach $2,500.0 million by 2025, driven by a strong emphasis on sustainability and innovation. The region's regulatory frameworks promote responsible fishing practices, which are crucial for maintaining fish stocks and ensuring long-term market viability. Additionally, the growing demand for fishmeal in aquaculture and pet food sectors is propelling market growth, as consumers increasingly seek sustainable protein sources. Leading countries such as Norway, Denmark, and the UK are at the forefront of the fishmeal industry, with key players like Nutreco and Austevoll Seafood leading the charge. The competitive landscape is marked by a strong focus on research and development, with companies investing in new technologies to enhance production efficiency and product quality. This innovation-driven approach positions Europe as a leader in The Fishmeal.

Asia-Pacific : Dominating Global Market Share

The Asia-Pacific region is the largest fishmeal market, projected to reach $6,000.0 million by 2025, driven by the booming aquaculture industry. Countries like China and India are leading the demand for fishmeal, as they expand their aquaculture operations to meet the growing protein needs of their populations. Regulatory support for sustainable aquaculture practices is also a significant driver, ensuring the long-term viability of fishmeal production in the region. China stands out as the dominant player in the fishmeal market, with numerous local and international companies vying for market share. Key players such as Copesul and Marubeni Corporation are actively involved in the region, contributing to a competitive landscape that fosters innovation and efficiency. The presence of these major companies ensures a steady supply of high-quality fishmeal, catering to both domestic and international markets.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa fishmeal market is projected to reach $320.91 million by 2025, driven by increasing local demand for fishmeal in aquaculture and livestock feed. The region's growing population and rising income levels are contributing to a higher consumption of fish products, which in turn boosts the demand for fishmeal. Regulatory initiatives aimed at promoting sustainable fishing practices are also playing a crucial role in market development. Countries like South Africa and Egypt are leading the market in this region, with local players and international companies establishing a presence to meet the growing demand. The competitive landscape is evolving, with a mix of established firms and new entrants focusing on quality and sustainability. This dynamic environment presents opportunities for growth and innovation in the fishmeal sector.