Market Growth Projections

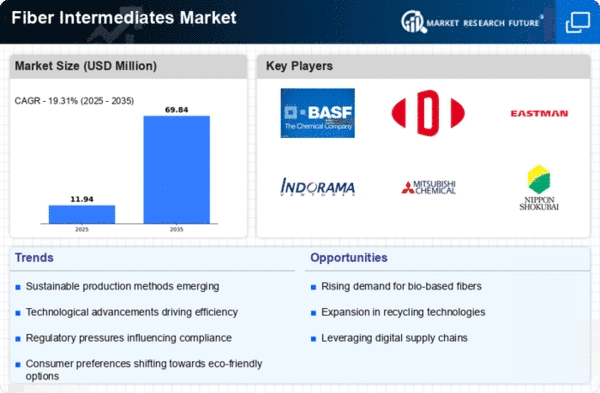

The Global Fiber Intermediates Market Industry is poised for substantial growth, with projections indicating a market value of 8.49 USD Million in 2024 and an anticipated increase to 20.6 USD Million by 2035. This growth trajectory suggests a compound annual growth rate of 8.37% from 2025 to 2035, reflecting the industry's resilience and adaptability to changing market conditions. The increasing demand for innovative and sustainable fiber solutions is likely to drive this growth, positioning the industry favorably in the global textile landscape.

Growth in the Apparel Sector

The apparel sector is a significant driver of the Global Fiber Intermediates Market Industry, as it accounts for a substantial portion of fiber consumption. With the global population projected to increase, the demand for clothing is expected to rise correspondingly. This growth is further fueled by changing fashion trends and the rise of fast fashion, which emphasizes rapid production cycles. As the market evolves, it is anticipated to reach 20.6 USD Million by 2035, highlighting the apparel sector's critical role in sustaining fiber intermediate demand and driving industry growth.

Expansion of Emerging Markets

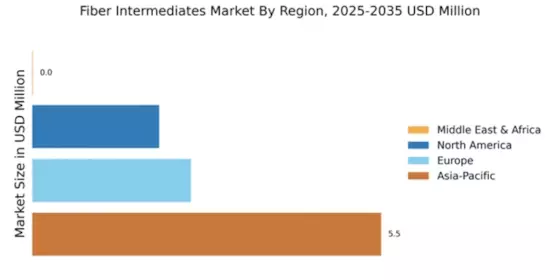

Emerging markets are becoming increasingly important in the Global Fiber Intermediates Market Industry. Countries in Asia-Pacific and Latin America are witnessing rapid industrialization and urbanization, leading to heightened demand for textiles and fibers. As these regions develop, local manufacturers are likely to invest in fiber production capabilities, thereby enhancing market dynamics. This expansion is expected to contribute significantly to the overall growth of the industry, as emerging markets represent a substantial opportunity for fiber intermediates, potentially reshaping global supply chains.

Rising Demand for Sustainable Textiles

The Global Fiber Intermediates Market Industry is experiencing a notable shift towards sustainable textiles, driven by increasing consumer awareness regarding environmental issues. As brands and manufacturers prioritize eco-friendly materials, the demand for bio-based fibers is expected to rise. This trend is reflected in the projected market growth, with the industry anticipated to reach 8.49 USD Million in 2024. The shift towards sustainability not only aligns with consumer preferences but also encourages innovation in fiber production processes, potentially leading to a more circular economy in textiles.

Increasing Urbanization and Lifestyle Changes

Urbanization is a key factor influencing the Global Fiber Intermediates Market Industry. As more people migrate to urban areas, lifestyle changes lead to increased consumption of textiles and apparel. This urban shift often correlates with higher disposable incomes, allowing consumers to spend more on quality and fashionable clothing. Consequently, the demand for various fiber intermediates is expected to rise, supporting the industry's growth trajectory. The interplay between urbanization and changing consumer preferences suggests a robust future for the fiber intermediates market.

Technological Advancements in Fiber Production

Technological innovations are playing a crucial role in shaping the Global Fiber Intermediates Market Industry. Advanced manufacturing techniques, such as biotechnology and nanotechnology, are enhancing the efficiency and quality of fiber production. These advancements enable the development of high-performance fibers that meet diverse application needs, from apparel to industrial uses. As a result, the market is likely to witness a compound annual growth rate of 8.37% from 2025 to 2035, reflecting the industry's adaptability to evolving technological landscapes and consumer demands.