Market Trends

Key Emerging Trends in the Fiber Intermediates Market

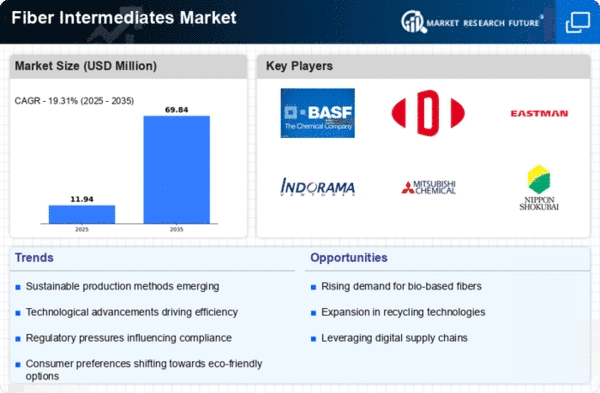

The fiber intermediates market, a pivotal sector within the textile and manufacturing industries, is currently shaped by several significant trends that define its dynamics. A comprehensive understanding of these market trends is essential for industry stakeholders to make informed decisions, stay competitive, and capitalize on emerging opportunities within this evolving market.

Growing Demand for Sustainable Fibers:

The fiber intermediates market is experiencing a surge in demand driven by the global emphasis on sustainable and eco-friendly fibers. Consumers' increasing awareness of environmental concerns is prompting the textile industry to prioritize fiber intermediates derived from sustainable sources and employing eco-friendly production processes. Rise of Bio-Based and Renewable Fiber Intermediates:

Bio-based fiber intermediates, derived from renewable resources such as biomass and agricultural by-products, are gaining prominence. Manufacturers are investing in research and development to produce bio-based intermediates as alternatives to traditional petrochemical-derived intermediates, aligning with the growing demand for greener textiles. Advancements in Recycling Technologies:

Recycling technologies are advancing in the fiber intermediates market, contributing to the circular economy approach. Recycled fiber intermediates, obtained from post-consumer and post-industrial sources, are becoming more prevalent as sustainability and circularity become key considerations in the textile industry. Focus on Specialty Fiber Intermediates:

There is a notable trend towards specialty fiber intermediates that offer enhanced properties, such as moisture-wicking, flame resistance, and antimicrobial features. Specialty intermediates cater to the increasing demand for functional and performance-driven textiles in industries ranging from sportswear to industrial applications. Technological Innovations in Production Processes:

Technological innovations are influencing the production processes of fiber intermediates, leading to increased efficiency and reduced environmental impact. Advanced processing methods, including enzymatic treatments and solvent technologies, contribute to resource-efficient and sustainable production. Global Expansion and Market Consolidation:

The fiber intermediates market is witnessing global expansion, with manufacturers seeking to tap into emerging markets with growing textile industries. Market consolidation through mergers and acquisitions is a prevalent trend, allowing companies to strengthen their market position and diversify product portfolios. Integration of Digital Technologies:

The integration of digital technologies, such as data analytics and smart manufacturing, is influencing the fiber intermediates market. Digitalization enhances production efficiency, quality control, and supply chain management, providing manufacturers with real-time insights and process optimization. Dynamic Changes in Fashion and Textile Trends:

Dynamic changes in fashion and textile trends directly impact the fiber intermediates market. The demand for specific types of fibers, such as sustainable and innovative materials, is influenced by evolving consumer preferences and design trends in the fashion industry. Focus on Cost-Efficient Production:

Cost efficiency remains a key focus in the fiber intermediates market, as manufacturers seek to optimize production processes and reduce overall manufacturing costs. Streamlining operations and investing in technologies that enhance cost efficiency contribute to the competitiveness of fiber intermediate producers. Influence of Regulatory Standards:

Adherence to regulatory standards related to environmental impact and product safety is a crucial consideration in the fiber intermediates market. Manufacturers align their processes with regulatory requirements to meet environmental standards and ensure the acceptance of their products in the market. Shift Towards High-Performance Fibers:

The demand for high-performance fibers with exceptional strength, durability, and versatility is driving the fiber intermediates market. High-performance fibers find applications in industries such as aerospace, defense, and medical textiles, contributing to the overall growth of the market. Consumer Preference for Natural and Organic Fibers:

Consumer preference for natural and organic fibers is influencing the fiber intermediates market. Manufacturers are responding to this trend by offering intermediates for fibers like organic cotton and hemp, catering to the growing demand for sustainable and chemical-free textiles.

Leave a Comment